Companies Like Tungsten Mining (ASX:TGN) Can Afford To Invest In Growth

Table of Contents

We can readily have an understanding of why investors are attracted to unprofitable businesses. For illustration, though Amazon.com built losses for a lot of a long time immediately after listing, if you experienced bought and held the shares given that 1999, you would have designed a fortune. Possessing reported that, unprofitable businesses are risky mainly because they could most likely melt away by all their income and turn into distressed.

So should really Tungsten Mining (ASX:TGN) shareholders be nervous about its income burn off? For the purposes of this article, dollars burn is the annual rate at which an unprofitable enterprise spends income to fund its development its destructive totally free income circulation. 1st, we are going to identify its cash runway by evaluating its money melt away with its income reserves.

See our most recent evaluation for Tungsten Mining

Does Tungsten Mining Have A Prolonged Money Runway?

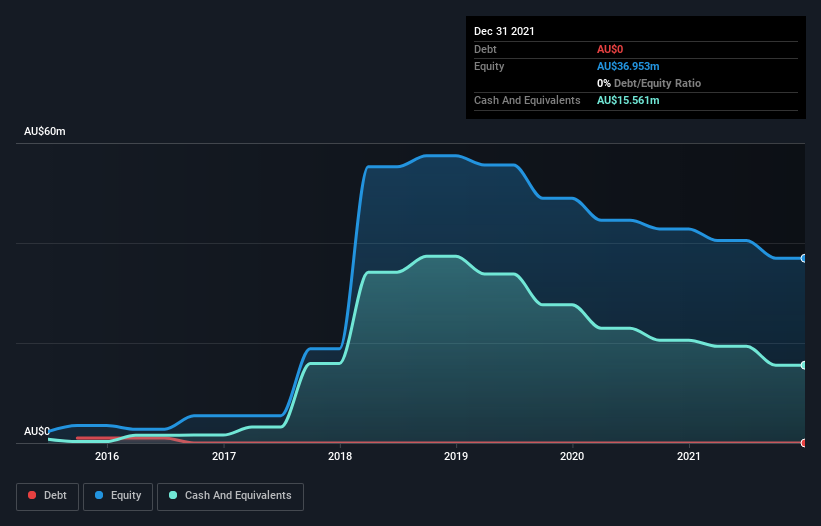

A cash runway is described as the length of time it would choose a corporation to operate out of cash if it stored paying at its present level of hard cash burn. As at December 2021, Tungsten Mining had hard cash of AU$16m and no financial debt. Importantly, its funds burn up was AU$5.3m about the trailing twelve months. Consequently, from December 2021 it experienced 2.9 decades of dollars runway. Which is good, providing the company a couple years to create its company. Depicted underneath, you can see how its cash holdings have adjusted over time.

How Is Tungsten Mining’s Cash Burn off Switching Around Time?

Though Tungsten Mining noted income of AU$88k final 12 months, it didn’t basically have any revenue from operations. That means we contemplate it a pre-revenue enterprise, and we will concentration our advancement investigation on hard cash burn up, for now. Even though it doesn’t get us fired up, the 25% reduction in hard cash burn off year on year does recommend the firm can proceed functioning for rather some time. Tungsten Mining helps make us a very little nervous thanks to its deficiency of substantial functioning profits. We desire most of the shares on this checklist of shares that analysts expect to expand.

How Tricky Would It Be For Tungsten Mining To Raise Much more Income For Expansion?

Although Tungsten Mining is displaying a solid reduction in its income burn up, it is really however worth taking into consideration how easily it could elevate extra funds, even just to gas a lot quicker development. Businesses can elevate funds by either credit card debt or fairness. Commonly, a organization will offer new shares in by itself to raise income and travel growth. By evaluating a firm’s yearly money burn to its complete market place capitalisation, we can estimate about how numerous shares it would have to issue in purchase to run the corporation for one more yr (at the exact burn off amount).

Given that it has a market capitalisation of AU$79m, Tungsten Mining’s AU$5.3m in cash burn off equates to about 6.7% of its industry value. Offered that is a alternatively small percentage, it would possibly be really simple for the business to fund a further year’s advancement by issuing some new shares to investors, or even by getting out a loan.

How Dangerous Is Tungsten Mining’s Income Burn Situation?

As you can most likely notify by now, we’re not far too nervous about Tungsten Mining’s dollars melt away. In particular, we believe its cash runway stands out as evidence that the company is very well on major of its paying out. And even however its dollars burn off reduction wasn’t fairly as amazing, it was nevertheless a good. Soon after getting into account the numerous metrics talked about in this report, we are fairly comfortable with how the corporation is shelling out its hard cash, as it would seem on observe to fulfill its demands above the medium time period. Individually, we appeared at distinctive threats influencing the enterprise and noticed 3 warning signs for Tungsten Mining (of which 2 cannot be overlooked!) you must know about.

Of study course Tungsten Mining could not be the best stock to acquire. So you may possibly would like to see this free of charge collection of corporations boasting significant return on equity, or this listing of stocks that insiders are purchasing.

Have opinions on this report? Concerned about the content? Get in contact with us specifically. Alternatively, electronic mail editorial-workforce (at) simplywallst.com.

This post by Only Wall St is common in character. We supply commentary dependent on historic info and analyst forecasts only working with an impartial methodology and our articles are not intended to be fiscal advice. It does not constitute a advice to acquire or sell any stock, and does not get account of your goals, or your economical situation. We purpose to bring you extended-expression concentrated assessment driven by basic info. Observe that our investigation may well not issue in the latest value-sensitive company bulletins or qualitative materials. Just Wall St has no place in any shares mentioned.