CyberArk’s (CYBR) Q1 Loss Matches Estimates, Revenues Miss

Table of Contents

CyberArk Software CYBR reported non-GAAP loss of 30 cents, which came in line with the Zacks Consensus Estimate. The bottom line was lower than the year-ago quarter’s non-GAAP earnings of 9 cents per share.

For first-quarter 2022, the leading Identity Security solution provider reported revenues of $127.6 million, missing the consensus mark of $131.1 million. The top line, however, witnessed a year-over-year improvement of 13%. Markedly, 84% of quarterly revenues were recurring in nature, which surged 40% year over year to $107 million.

Annual Recurring Revenues (ARR) increased 48% to $427 million. The maintenance portion, representing 48.7% of total ARR, increased 3.5% year over year to $208 million. The subscription portion, which accounted for 51% of the total ARR, soared 149% year over year to $219 million. This upside was primarily driven by a record number of software-as-a-service (“SaaS”) solutions bookings and strong demand for on-premises subscription offerings.

CyberArk’s subscription transition has been witnessing strong momentum, with a rapidly growing base of recurring revenues. Subscription bookings made up 86% of the license bookings in the quarter, which was significantly higher than 51% in the year-ago quarter and outpaced management’s target of achieving an 85% subscription bookings mix.

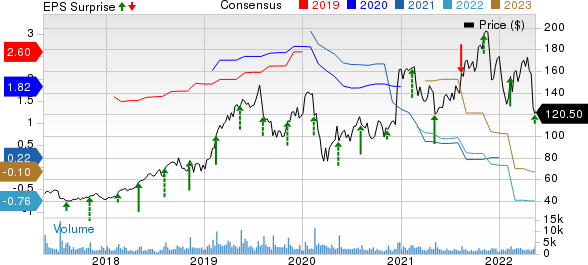

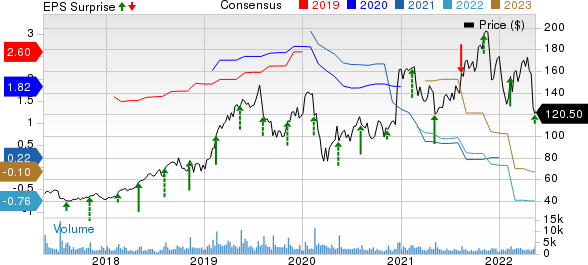

CyberArk Software Ltd. Price, Consensus and EPS Surprise

CyberArk Software Ltd. price-consensus-eps-surprise-chart | CyberArk Software Ltd. Quote

Quarter Details

Segment-wise, subscription revenues (40.1% of total revenues) were $51.9 million, up by 110% from the year-ago quarter.

Maintenance and professional services revenues (51% of total revenues) climbed 6.2% to $65.1 million from the year-ago quarter.

Perpetual license revenues (8.3% of total revenues) plunged 60.3% to $10.6 million at the close of this quarter.

The signing of new logos across all industries highlighted a steady increase in new business. The new business pipeline is encouraging.

During the first quarter, CyberArk added around 250 new customers.

Operating Details

CyberArk’s non-GAAP gross profit increased 8.9% year over year to $104.1 million.

Non-GAAP operating expenses escalated 28.6% year over year to $115.9 million. This was primarily due to 46.1%, 26.1% and 23.1% year-over-year increases in R&D, S&M and G&A expenses, respectively, from the year-earlier reported figures. S&M expenses comprised almost 55.1% of the total quarterly operating expenses.

The company’s non-GAAP operating loss was $11.8 million at the end of first-quarter 2022, against non-GAAP operating income of $5.5 million a year ago.

Balance Sheet

CyberArk ended the January-March quarter with cash and cash equivalents, marketable securities, and short-term deposits of $1.2 billion.

As of Mar 31, 2022, total deferred revenues were $345.2 million, up 33% year over year.

During the first quarter, CyberArk generated operating cash flow worth $25 million and free cash flow worth $23 million.

Guidance

For the second quarter of 2021, CyberArk expects revenues between $135 million and $141 million. It projects to post non-GAAP loss per share in the range of 25 cents to 37 cents.

Non-GAAP operating loss is estimated between $9.5 million and $14.5 million.

For full-year 2022, CyberArk expects revenues to be $583.5-$598.5 million. The company now projects non-GAAP loss to be 60-92 cents per share, compared with the previously estimated range of 64-98 cents per share.

Non-GAAP operating loss for full-year 2022is estimated in the $20.5-$33.5 million band.

Zacks Rank & Other Key Picks

CyberArk currently carries a Zacks Rank #2 (Buy). Shares of CYBR have decreased 0.8% in the past year.

Some other top-ranked stocks from the broader Computer and Technology sector are Avnet AVT, Axcelis Technologies ACLS and Analog Devices ADI. While Avnet and Axcelis sport a Zacks Rank #1 (Strong Buy), Analog Devices carry a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Avnet’s fourth-quarter fiscal 2022 earnings has been revised 55 cents northward to $1.96 per share over the past 30 days. For 2022, earnings estimates have moved 20.5% north to $6.83 per share in the past 30 days.

Avnet’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 21.2%. Shares of AVT have increased 4.5% in the past year.

The Zacks Consensus Estimate for Axcelis’ second-quarter 2022 earnings has been revised 3 cents upward to 99 cents per share over the past seven days. For 2022, ACLS’ earnings estimates have moved 11 cents north to $4.10 per share in the past seven days.

Axcelis’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 23.5%. Shares of ACLS have surged 41.8% in the past year.

The Zacks Consensus Estimate for Analog Devices’ second-quarter fiscal 2022 earnings has been revised 4 cents upward to $2.12 per share over the past 60 days. For fiscal 2022, earnings estimates have moved 11 cents north to $8.43 per share in the past 60 days.

Analog Devices’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6%. Shares of ADI have risen 2.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report