Amyris Stock: Revenues Need To Catch Expenses (NASDAQ:AMRS)

Table of Contents

ktsimage

Many investors expect that once Barra Bonita is fully operational, Amyris (NASDAQ:AMRS) will be highly profitable. While Barra Bonita will improve Amyris’ financials, manufacturing is only one component of costs. Amyris is vertically integrating, which introduces fixed costs and can be a heavy burden when operating below the optimal scale. With sufficient resources to generate 500-1,000 million USD in product revenue, Amyris needs to grow into its cost structure. This situation is being exacerbated by supply chain issues and elevated customer acquisition costs for DTC companies. The true economics of Amyris’ business should become clearer over the next 12 months and will be dependent on the strength of their consumer brands and production costs for their ingredients business.

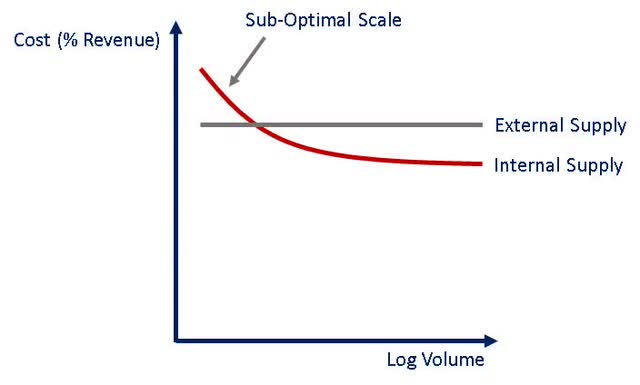

Figure 1: Impact of Internal versus External Supply on Costs (source: Created by author)

Amyris is engaged in three very different core activities, which need to be considered separately when trying to understand cost drivers:

R&D – Amyris develops organisms that produce molecules through fermentation. These molecules are monetized through their ingredients or consumer products businesses. The R&D business can also generate revenue by performing services for customers and through licensing and royalties. R&D is largely a fixed cost that must be covered by profits from the other businesses.

Ingredients – Amyris sells ingredients b2b, the economics of which are driven by fermentation costs. Amyris have been reliant on expensive 3rd party fermentation and have realized ingredients revenue upfront through contracts with customers. As a result, the ingredients business has likely been losing money on a gross profit basis.

Consumer Products – Amyris has built a number of consumer brands around their fermented molecules. The economics of this business is largely driven by customer acquisition costs. Competition amongst DTC brands and Apple’s privacy changes have increased customer acquisition costs for DTC brands in recent years.

Gross Margins

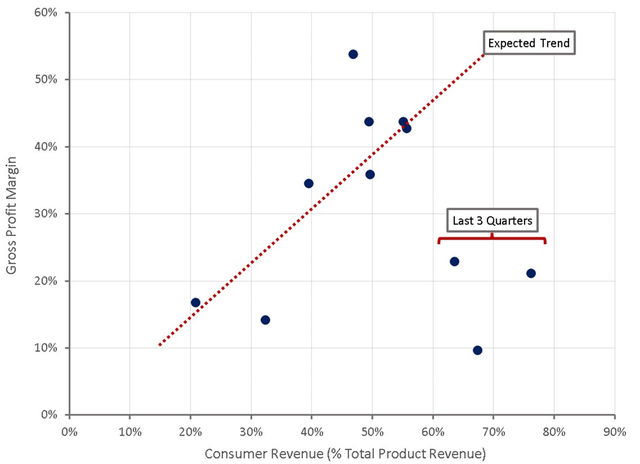

Amyris’ ingredients and consumer businesses have very different gross margin profiles, and hence gross profit margins are highly dependent on the revenue split between these businesses. Amyris have stated that they are targeting gross profit margins of 35-40% for the ingredients business and 65% for the consumer business. As consumer products become the dominant driver of revenue for Amyris, gross profit margins should rise. This trend has generally been observed in the past, except for the last 3 quarters where a number of factors have depressed margins.

Figure 2: Amyris Gross Profit Margins (source: Created by author using data from Amyris)

Amyris are in the process of bringing consumer product manufacturing and fermentation in house. There are costs associated with starting up these operations, which have been incurred while still having to pay for third party manufacturing and fermentation. Amyris plans to be performing over 70% of consumer product manufacturing internally by the fourth quarter of 2022. They estimate that this, along with a move to their own fulfilment, will add 5% to consumer gross profit margins. At the end of the first quarter of 2022, 10% of their highest volume products were already produced in Reno.

Amyris now has consumer manufacturing facilities in Reno and Brazil, with the Reno facility having a capacity of 50 million units per year on one shift and the Brazilian site having a capacity of 30 million units per year on one shift. Amyris have stated that these facilities should support about 400-500 million USD of consumer revenue annually, assuming that 70-80% of demand is met by their own manufacturing capacity. The production of some items will continue to be performed by third parties as they are unique to the point that it doesn’t make sense for Amyris to invest in the capital equipment necessary to manufacture them.

Production of Vanillin at the Barra Bonita plant recently began, marking the beginning of an insourcing of fermentation. Amyris plans to produce most of their ingredients at Barra Bonita in the second half of 2022 and expect that this will result in a 20% improvement in gross profit margins for the ingredients business. Amyris expect that by the third quarter Barra Bonita will be fully operational and supplying most of their ingredients, except carnosine, which will continue to come from the plant acquired by DSM. Commercial production was slated to begin with F&F ingredients in Q2, followed by nutrition products in the second half of the year and then farnesene, etc. Amyris have stated that Barra Bonita will enable approximately 200 million USD of ingredients revenue annually.

Improvements in fermentation costs are likely to be due to a combination of improved operational efficiency and the elimination of high mark-ups by third parties. Demand for contract manufacturing is currently high and supply constrained, leading to high costs. Amyris is also reliant on fermentation in Spain, where costs are further elevated by energy prices.

Barra Bonita has been specifically designed for the precision fermentation of Amyris’ molecules and as a result efficiency should be higher than generic third-party facilities. Amyris is utilizing a vertical fermentation design to reduce power requirements and 50% more input lines and control sensors. There are also likely to be significant gains in downstream processing, which is often process specific and hence more difficult for CMOs to manage.

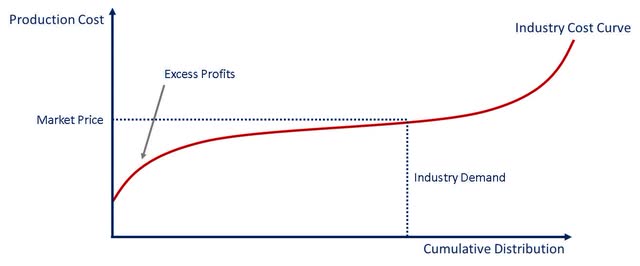

Despite essentially being a commodity business, ingredients could be reasonably profitable for Amyris if they can achieve the right cost structure. Molecules in Amyris’ pipeline generally have a 40-50% cost advantage over current production methods. Depending on how market prices are impacted by Amyris’ production, gross margins should therefore be expected to fall in the 30-55% range.

Figure 3: Example Cost Curve in a Commodity Market (source: Created by author)

Supply chain issues have weighed heavily on Amyris over the past year. In the first quarter of 2022 management attributed 20 million USD to global supply chain issues. This was due to higher manufacturing costs, elevated freight costs and air freight to deal with delays. Amyris have been building inventory to help manage supply chain uncertainty and freight costs are now in freefall, meaning supply chain issues are unlikely to be a major issue going forward.

Amyris is planning an accounting change that will negatively impact gross margins in the second half of the year. Pick, pack and ship costs are currently included in operating expenses but will be moved to COGS. Amyris expect this change to reduce operating expenses by 20%, but the impact on gross margins should be offset by the gains discussed above.

Operating Margins

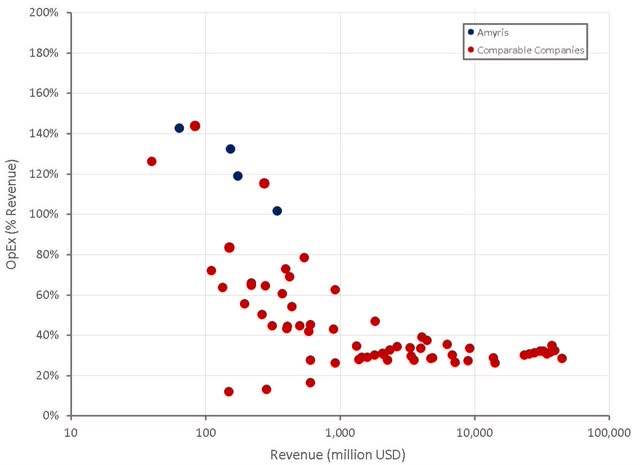

While improvements in gross profit margins are important, operating expenses are the primary concern for Amyris.

Figure 4: Amyris Operating Expenses (source: Created by author using data from company reports)

Management have stated that they are targeting quarterly cash operating costs of 85-90 million USD, with another 11 million USD of stock-based compensation. This will be achieved by moving pick, pack and ship costs to COGS, along with a 10 million USD reduction in spending on outside services and a 20 million USD reduction of marketing spend.

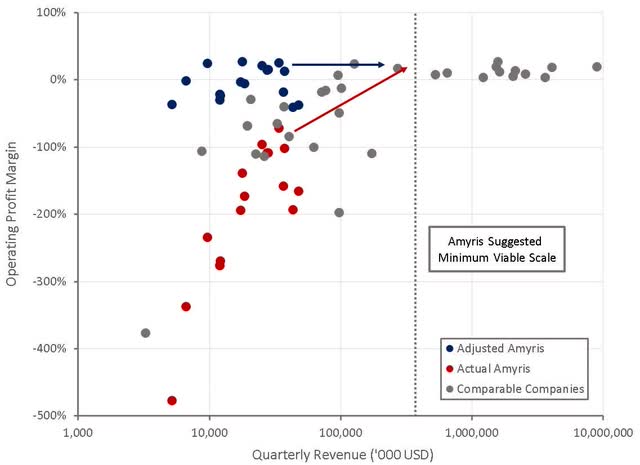

Amyris are targeting 1 billion USD revenue in 2024 with 20% operating profit margins. Margins will not be maximized until annual revenue is above 1.5 billion USD, with Amyris targeting gross margins of 60-65% and adjusted EBITDA margins of 30-35% (operating margins of 20-25%). SG&A expenses are expected to stabilize at around 500 million USD per year and R&D costs are currently around 100 million USD per year.

By capitalizing investments in intangible assets and adjusting for operating leverage, a clearer picture of Amyris’ profitability, independent of scale or growth, emerges. This again points towards operating margins around 20%, achieved at a scale of approximately 1.5 billion USD annual revenue. Adjusting margins for growth and scale is somewhat subjective and assumes that the optimal scale will eventually be achieved and that investments in intangibles are productive.

Figure 5: Amyris Operating Profit Margins (source: Created by author using data from company reports)

Employee Expenses

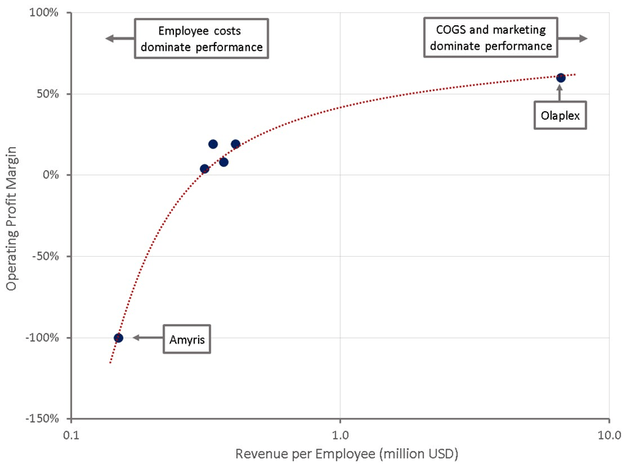

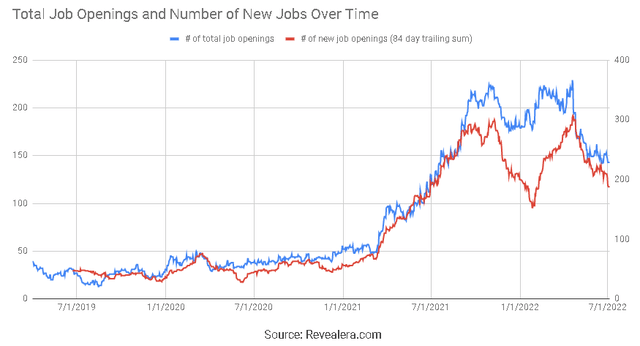

Much of Amyris’ current predicament is due to the fact that they are investing ahead of growth and have a large R&D business. Amyris have acquired or launched 6 consumer brands in the past 12-18 months and plan to launch another 3 this year. There is a headcount associated with each of these brands, even if they are not currently generating much revenue. In addition, Amyris is insourcing a number of activities, which is contributing to growth in the number of employees. Amyris likely currently has somewhere around 1,200 employees and in 2021 their median annual total compensation was 117,489 USD. Average compensation is likely to skew significantly higher as Amyris employs a large number of PhDs. Given this and other non-compensation expenses tied to employees (training, insurance, etc.) it would not be surprising if annual employee related expenses were around 200 million USD. Employee expenses increased by 88 million USD on an annualized basis between Q1 2021 and Q1 2022 alone. Amyris needs to scale their business significantly to cover these expenses, which will take time.

Figure 6: Operating Profit Margins and Employee Efficiency for Beauty Brands (source: Created by author using data from company reports) Figure 7: Amyris Hiring Trends (source: Revealera.com)

Marketing Expenses

Marketing is another key cost driver for Amyris and is the key to their consumer business. One of the main concerns regarding Amyris should be if their brands are actually performing poorly and sales are only being achieved using large marketing budgets. Marketing efficiency is important not just for Amyris’ financials, but would be a large determinant of valuation should Amyris decide to divest a brand.

Amyris do not break out marketing expenses, but it is likely that this is currently close to 100 million USD per year. Given that consumer revenue is only approximately 130 million USD, this is quite concerning. John Melo has stated that for a new brand, marketing expenses are generally 100% of sales and for a mature brand, 12.5% of sales. Given that most of Amyris’ brands are new, and growing rapidly, it should be expected that marketing expenses are elevated.

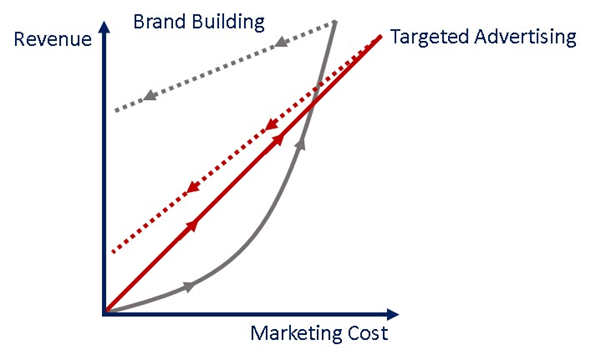

Not all marketing spend is the same either. Marketing can be used to create consumer awareness and a favorable opinion of a brand without directly trying to create sales. Marketing can also be aimed at creating immediate purchases, with little consideration for long-term brand value. The relationship between marketing spend and revenue growth is more direct with targeted advertising, but brand advertising can continue to generate sales long after it ends.

If Amyris is primarily engaged in brand building, their elevated marketing expenses would be more understandable. It is likely that this is the case as educating consumers about relatively unknown molecules like hemi-squalane is a key part of their marketing strategy. Amyris’ brands have a strong narrative (sustainable production), differentiated chemistry and customer feedback is generally extremely positive.

Olaplex (OLPX) is a clear example of how a strong brand with a unique product can generate large amounts of revenue with limited marketing. At the other end of the scale are hundreds of DTC companies with generic products that rely completely on efficient targeted advertising.

Figure 8: Impact of Brand Advertising versus Targeted Advertising (source: Created by author)

Amyris plan to reduce marketing spend by 20 million USD a quarter going forward, with half attributed to a drop in spending and half to an optimization of spending. How sales respond to a reduction in marketing will be an indicator of the strength of Amyris’ brands and their relationship with consumers. If revenue growth remains relatively stable as marketing spend is reduced, it will be a solid indicator that Amyris has created real value.

The way that Amyris has managed Terasana is one indication that the company is closely monitoring returns on advertising and is willing to sacrifice growth when it makes sense. Terasana has struggled to acquire customers and as a result Amyris is going back to the drawing board, rather than throwing marketing dollars at the problem.

Amyris’ marketing expenses may not be as bad as they appear, but it is likely that customer acquisition is an area that they are finding difficult. Marketing has become expensive for DTC brands in recent years and Apple’s (AAPL) privacy changes have added to these costs. Rising customer acquisition costs is potentially part of the reason that Amyris purchased MG Empower. It is also likely the reason that Amyris has begun utilizing experiential stores.

The burden of marketing is also likely to change as the retail channel grows in importance relative to the DTC channel. Amyris’ retail doors have expanded rapidly over the past 12 months and consumer spending is shifting offline in the wake of the pandemic. Amyris appears to have quite good relationships with retail channel partners like Sephora and Walmart (WMT). With support from these partners, particularly as Amyris launches a brand for Walmart, the burden of marketing expenses may decline.

Conclusion

Amyris now has the resources (brands, ingredients, employees, manufacturing facilities) to generate up to 1 billion USD in revenue annually, and the business will not be profitable until revenues are sufficient to cover the cost of these resources. Amyris should achieve significant growth this year through a number of avenues:

- 3-5 new ingredients

- 3 new consumer brands

- Growth from existing consumer brands

- Rapid expansion in retail doors

- International expansion

The current cost structure is quite reckless given the deteriorating macro environment and fall in valuations for growth stocks. If growth cannot be realized, Amyris’ cost structure and balance sheet leave it in a vulnerable position. But, provided growth remains robust, Amyris remains on track to become sustainably profitable on an operating profit basis in 2023.