An Iconic Company Facing Pressures

Almost each and every organization in The united states has been complaining about inflationary pressures, significantly provide chain and transport costs. But what if a corporation is section of the provide chain?

FedEx Corporation (NYSE:FDX) is a single these types of company. It supplies transportation, e-commerce and business products and services on a international basis. The FedEx Specific phase features convey transportation, small-package deal ground supply, freight transportation companies, time-critical transportation solutions and cross-border e-commerce associated answers. The FedEx Floor segment provides working day-selected shipping and delivery providers to businesses and residences across North The us. The companys FedEx Freight phase gives so-identified as much less-than-truckload freight transportation products and services. Fedex operates the world’s premier cargo only air fleet and has more than 30,000 automobiles in its world-wide functions.

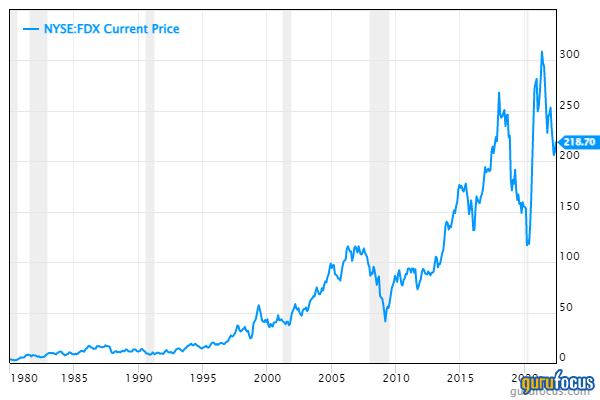

The business was launched in 1971 by Fred Smith and has grown to $84 billion in revenues and a $56 billion sector capitalization. Even so, the stock has a short while ago been coming off of its highs. It now appears undervalued in my watch I imagine buyers are underestimating the long-phrase prospective clients.

Money assessment

In March, FedEx described fiscal third-quarter success for the time period ending Feb. 28. Revenues elevated 10% in comparison to the prior 12 months interval, adjusted internet cash flow elevated 30% and altered EPS improved 32%.

On a phase basis, FedEx Convey running effects improved, with revenues jumping 5.% and working profits up 12%, pushed by greater yields, a web gas advantage and decrease variable compensation expenditure. The improved outcomes ended up rather offset by the detrimental results of a Covid resurgence throughout the quarter, which afflicted limited-expression financial expansion, labor availability and delivery need.

FedEx Ground revenues amplified 10% but functioning revenue declined 9.%, mostly thanks to amplified costs for acquired transportation and staff wages, community inefficiencies and enlargement-relevant expenditures.

FedEx Freight revenues amplified 23% and functioning cash flow virtually tripled, which was driven by a continued concentrate on profits good quality and profitable expansion according to the business. Earnings per cargo greater 19% and typical day-to-day shipments grew 2% during the quarter, although the working margin amplified 850 basis points to 15.%.

The company commented:

We properly executed for the duration of the holiday getaway peak time, resulting in report December working earnings, explained Michael C. Lenz, FedEx Corp. executive vice president and main economic officer. Our powerful quarterly running cash flow improve was dampened by the surge of the Omicron variant which caused disruptions to our networks and diminished consumer need in January and into February. We stay concentrated on income quality and operational effectiveness initiatives to mitigate inflationary pressures and generate earnings improvement.

Valuation

The company gave marginally intricate advice for 2022 due to the incapacity to forecast the mark-to-market price of its retirement ideas, generally owing to the new fluctuations in fascination charges.

Right before adjustments and uncommon merchandise, FedEx expects to generate involving $20.50 and $21.50 for each share for the fiscal yr ending May 2022. Analyst EPS estimates are largely in line with these figures, coming in about $20.60 per share. That places FedEx pretty near to signing up for the one-digit forward cost-earnings ratio club that has proliferated in recent months, and if one particular considers 2023 approximated earnings, then the valuation seems to be even lower. The organization sells at a forward company-benefit-to-Ebitda ratio of about 8.

Utilizing the GuruFocus DCF calculator, a bought a truthful benefit estimate of about $300 for every share dependent on starting off EPS of $20.50 and a 5.% lengthy-time period expansion rate. The companys current dividend generate is around in line with industry regular at 1.37%.

Guru trades

Gurus who have obtained or extra to their positions in FedEx stock recently incorporate Charles Brandes (Trades, Portfolio) and Tom Gayner (Trades, Portfolio). Gurus who have diminished or bought out of their positions consist of Very first Pacific Advisors (Trades, Portfolio) and Jim Simons (Trades, Portfolio).

Conclusion

Fedex appears to be undervalued at this time for traders with a extended-phrase time horizon, in my viewpoint. I consider men and women are overestimating the superior gasoline prices and inflationary pressures. The major problem for the fiscal fourth quarter and entire-12 months outcomes is, can the company overcome the historic degrees of these gas price boost? Most of FedEx’s clients can be billed a gasoline surcharge to regulate for all those issues, but no matter whether it really is in fact acknowledged without having a significant downturn in volumes has yet to be observed. Even so, FedEx has the world-wide infrastructure that must deliver a competitive benefit about time.

This posting initial appeared on GuruFocus.