CVRx Pursues Revenue Growth But Operating Losses Worsen (NASDAQ:CVRX)

Table of Contents

Tashi-Delek

A Quick Take On CVRx

CVRx (NASDAQ:CVRX) went public in June 2021, raising approximately $126 million in gross proceeds from an upsized IPO that was priced at $18.00 per share.

The firm is commercializing a device that improves cardiovascular function in patients with heart failure.

CVRX has a promising product portfolio and is continuing its expansion plans but faces risks and higher operating losses amid an increasing cost of capital environment.

I’m on Hold for CVRX in the near term.

CVRx Overview

Minneapolis, Minnesota-based CVRx was founded to develop its BAROSTIM device that sends persistent electrical pulses to baroreceptors inside the wall of the carotid artery as a signal to the brain to modulate cardiovascular function.

Management is headed by President and CEO, Nadim Yared, who has been with the firm since 2006 and was previously Vice President and General Manager of Medtronic Navigation.

The firm sells its BAROSTIM NEO to hospitals through its direct sales organizations in the U.S. and Germany and through distributors in other European countries.

CVRx’s Market & Competition

CVRx’s market is focused on the cardiovascular system’s use of neuromodulation functions.

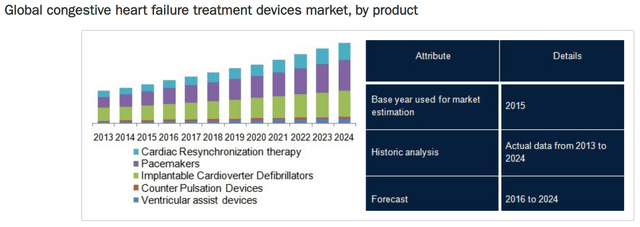

The global congestive heart failure device market size was an estimated $15.6 billion in 2015 and is projected to grow to $31.4 billion by 2024, according to a report by Grand View Research.

This growth would represent a CAGR of 8.1% from 2016 to 2024.

The historical and projected future growth trajectory of the global market for heart failure treatment devices is shown below:

Global Heart Failure Devices Market (Grand View Research)

There are a variety of industry market participants depending on product type:

- Medtronic

- Boston Scientific

- Biotronik SE & Co.

- KG

- St. Jude Medical

- Abbott Laboratories

- LivaNova

- Impulse Dynamics

CVRx’s Recent Financial Performance

-

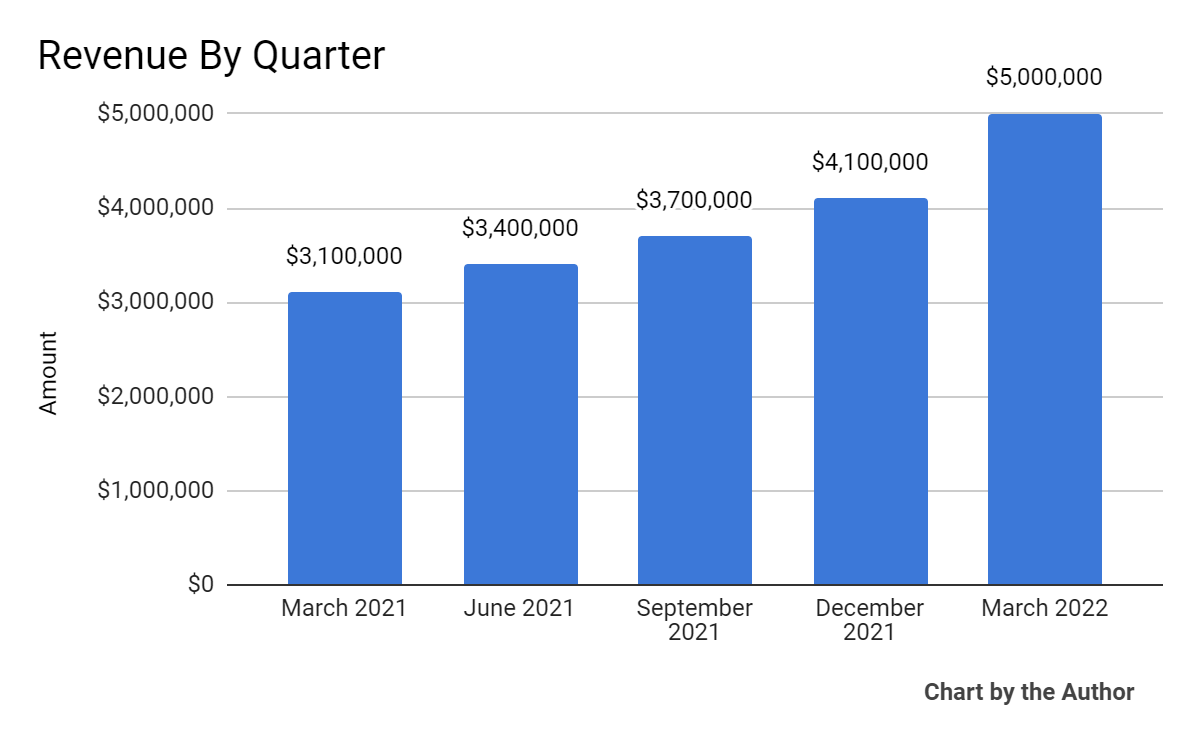

Total revenue by quarter has grown from a small base:

5 Quarter Total Revenue (Seeking Alpha)

-

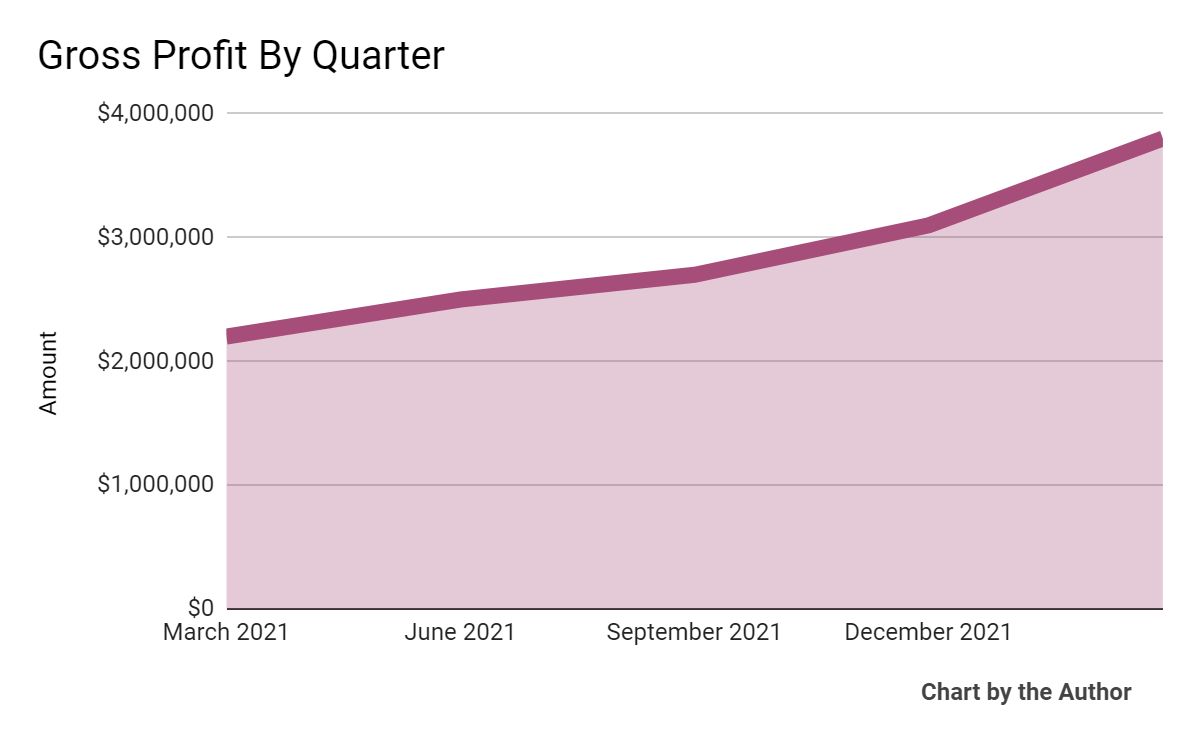

Gross profit by quarter has also risen as revenue has increased:

5 Quarter Gross Profit (Seeking Alpha)

-

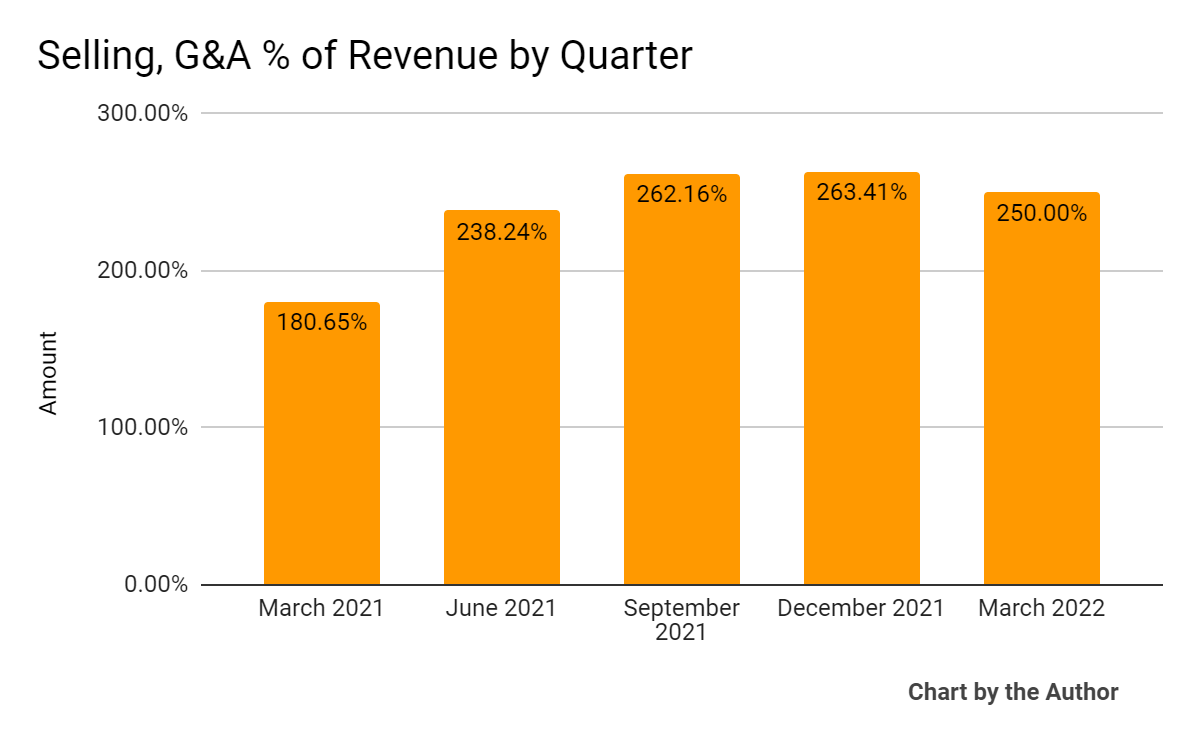

Selling, G&A expenses as a percentage of total revenue by quarter have remained high as the firm has ramped up its sales efforts:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

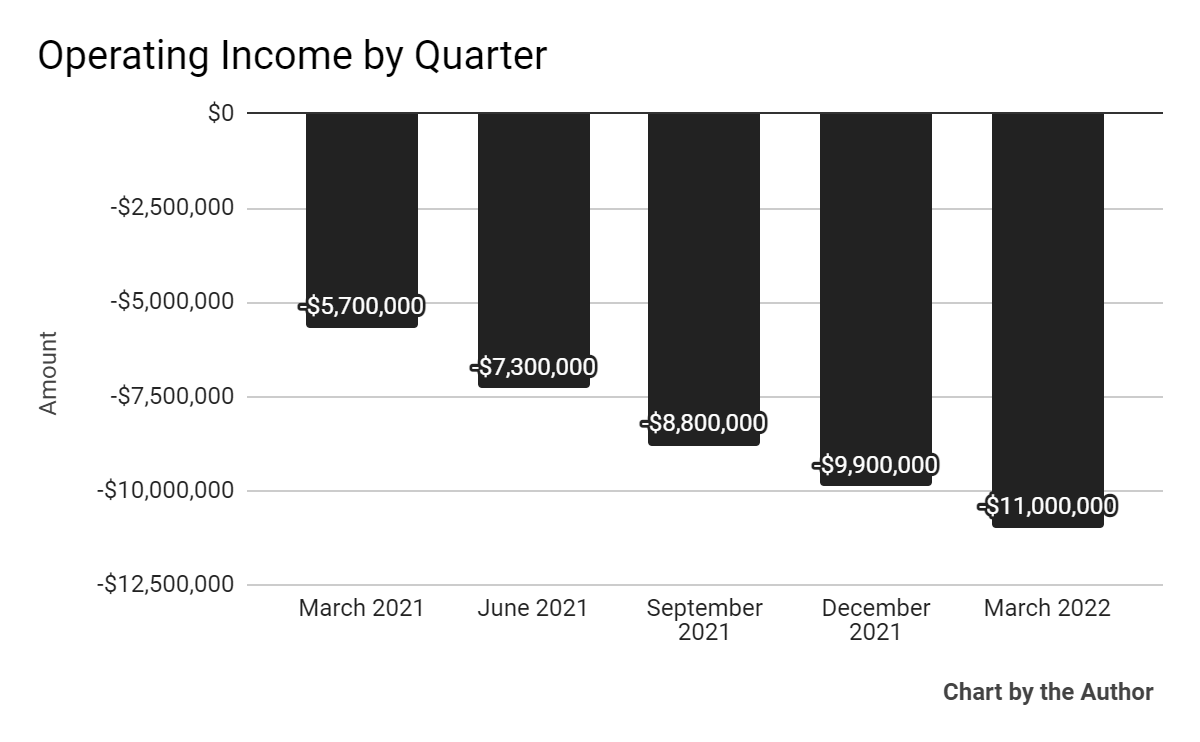

Operating losses by quarter have increased markedly in recent reporting periods:

5 Quarter Operating Income (Seeking Alpha)

-

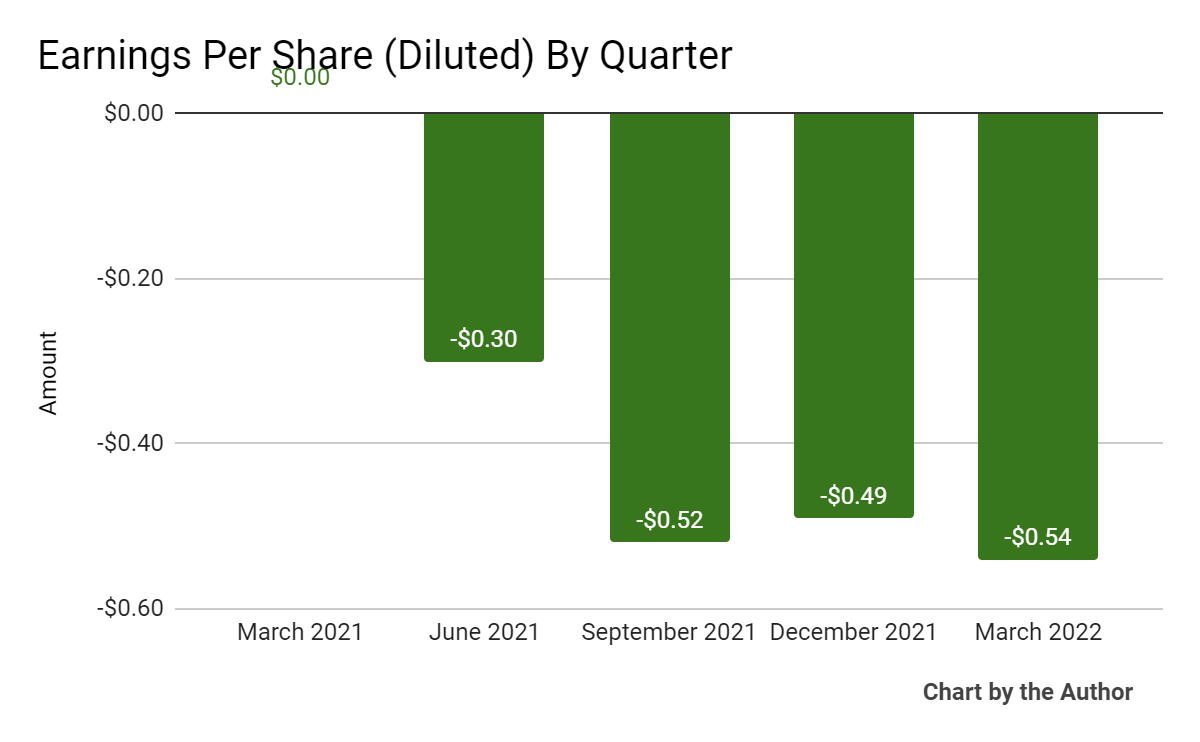

Earnings per share (Diluted) have also become increasingly negative in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

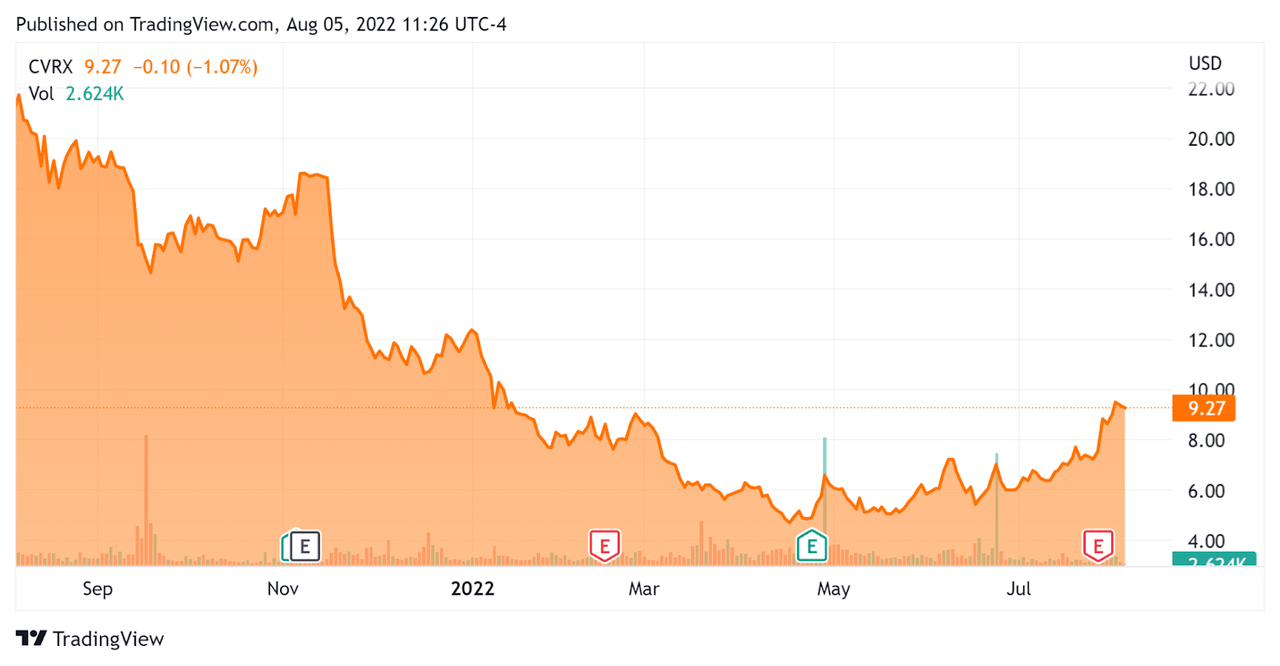

In the past 12 months, CVRX’s stock price has fallen 56% vs. the U.S. S&P 500 Index’s drop of around 6.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For CVRx

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$71,920,000 |

|

Market Capitalization |

$192,800,000 |

|

Enterprise Value/Sales (TTM) |

4.45 |

|

Revenue Growth Rate (TTM) |

78.21% |

|

Operating Cash Flow (TTM) |

-$36,970,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.85 |

(Source – Seeking Alpha)

Commentary On CVRx

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted topline revenue growth as being due to adding new implanting centers as customers as well as existing locations increasing their usage.

Management is focused on expanding its commercial network, continuing to develop its portfolio, and growing the clinical body of evidence to support the use of its system.

The firm intends to continue investing in its commercialization activities in the U.S. and Europe.

As to its financial results, total revenue reached $5.0 million, representing 61% growth year-over-year.

Gross margin rose to 76% versus 71% in Q2 2021 due to price increases and manufacturing cost decreases.

The main growth element on the cost side was for SG&A expenses, which grew by 122% year-over-year due to increasing headcount, growing stock-based compensation and increasing spend in marketing and advertising.

As a result, operating losses continue to worsen, reaching $11 million during the quarter.

For the balance sheet, the company finished the quarter with $121.3 million in cash and equivalents, using $10.1 million in free cash during Q2.

Looking ahead, management expects revenue to be $21.8 million at the midpoint of the range for 2022, with gross margin around 75.5% and operating expenses at $59.5 million at the midpoint.

Regarding valuation, the market is valuing CVRX at a trailing EV/Sales multiple of 4.45x despite its high revenue growth rate.

The primary risk to the company’s outlook is an outbreak of COVID conditions in the U.S. or Europe, which would have a slowing effect on procedures.

Also, the company is producing high and increasing operating losses, which given the rising cost of capital leads to a lower valuation multiple.

A potential upside catalyst to the stock could include a reduction in interest rate rises and lower cost of capital assumptions, but given recent inflation projections, this upside catalyst may be a lower probability.

CVRX has a promising product portfolio and is continuing its expansion plans but faces risks and a higher cost of capital environment.

I’m on Hold for CVRX in the near term.