We’re Hopeful That Mount Ridley Mines (ASX:MRD) Will Use Its Cash Wisely

Table of Contents

Just mainly because a organization does not make any dollars, does not necessarily mean that the inventory will go down. For instance, despite the fact that Amazon.com built losses for a lot of yrs soon after listing, if you had bought and held the shares due to the fact 1999, you would have designed a fortune. But when the successes are well known, investors should really not overlook the quite a lot of unprofitable organizations that only melt away via all their income and collapse.

So ought to Mount Ridley Mines (ASX:MRD) shareholders be nervous about its money melt away? In this write-up, we define cash burn off as its annual (negative) free of charge money circulation, which is the amount of money of funds a firm spends every year to fund its growth. First, we’ll decide its money runway by evaluating its funds melt away with its hard cash reserves.

Check out out our latest examination for Mount Ridley Mines

Does Mount Ridley Mines Have A Very long Income Runway?

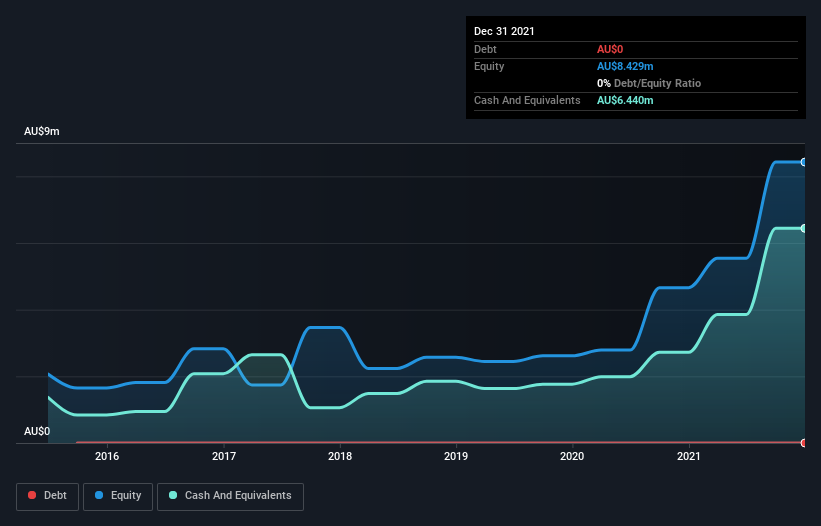

You can work out a company’s income runway by dividing the volume of money it has by the price at which it is paying that income. When Mount Ridley Mines very last described its harmony sheet in December 2021, it experienced zero debt and cash value AU$6.4m. Importantly, its hard cash melt away was AU$2.5m more than the trailing twelve months. Thus, from December 2021 it experienced 2.6 several years of funds runway. Which is first rate, offering the business a couple a long time to produce its organization. You can see how its funds equilibrium has altered about time in the picture underneath.

How Is Mount Ridley Mines’ Cash Melt away Altering About Time?

Whilst it really is fantastic to see that Mount Ridley Mines has presently begun generating revenue from functions, last yr it only produced AU$1.4k, so we do not assume it is creating sizeable profits, at this point. As a result, for the reasons of this analysis we’ll target on how the dollars melt away is monitoring. In simple fact, it ramped its paying out strongly in excess of the very last 12 months, escalating dollars melt away by 137%. It is really truthful to say that form of amount of raise are not able to be maintained for pretty long, without the need of placing tension on the stability sheet. Mount Ridley Mines helps make us a tiny anxious due to its deficiency of significant operating profits. So we would usually favor shares from this list of stocks that have analysts forecasting growth.

How Effortlessly Can Mount Ridley Mines Elevate Cash?

Offered its income melt away trajectory, Mount Ridley Mines shareholders could wish to look at how conveniently it could raise far more cash, inspite of its sound cash runway. Companies can increase funds by way of possibly credit card debt or fairness. Generally, a company will provide new shares in alone to increase income and generate growth. We can evaluate a firm’s cash melt away to its marketplace capitalisation to get a perception for how numerous new shares a firm would have to difficulty to fund just one year’s operations.

Mount Ridley Mines’ dollars burn up of AU$2.5m is about 7.% of its AU$35m industry capitalisation. Supplied that is a relatively modest proportion, it would most likely be genuinely easy for the company to fund another year’s expansion by issuing some new shares to buyers, or even by using out a mortgage.

How Dangerous Is Mount Ridley Mines’ Hard cash Burn up Circumstance?

It may well currently be apparent to you that we are fairly at ease with the way Mount Ridley Mines is burning through its hard cash. For example, we feel its cash runway implies that the company is on a superior path. Whilst we do uncover its growing dollars burn to be a little bit of a damaging, after we look at the other metrics described in this write-up alongside one another, the over-all picture is a single we are relaxed with. Centered on the things talked about in this article, we feel its money melt away condition warrants some notice from shareholders, but we you should not believe they must be worried. Individually, we looked at different challenges influencing the enterprise and noticed 4 warning indications for Mount Ridley Mines (of which 1 isn’t going to sit far too very well with us!) you should know about.

Of course, you could come across a wonderful financial investment by hunting elsewhere. So choose a peek at this cost-free list of firms insiders are getting, and this record of shares development shares (in accordance to analyst forecasts)

Have feed-back on this report? Concerned about the content material? Get in contact with us instantly. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This post by Merely Wall St is standard in character. We supply commentary dependent on historic facts and analyst forecasts only using an impartial methodology and our article content are not meant to be monetary suggestions. It does not represent a suggestion to obtain or offer any inventory, and does not get account of your targets, or your fiscal scenario. We intention to deliver you extended-phrase focused evaluation driven by basic details. Take note that our evaluation may perhaps not issue in the most current price tag-delicate organization bulletins or qualitative product. Only Wall St has no placement in any shares stated.