Why Technical Analysis Tools Are Better For Stock Trading

Table of Contents

When it will come to trading shares, many imagine the only opportunities in the sector are in buying lower and providing significant. When this is undoubtedly the objective of most traders, several technical strategies can be applied to help forecast when a stock is very likely to rise or tumble in value.

This report will analyse some of the most used technological analysis instruments and how they may possibly be utilised to make improved buying and selling selections. We will also discuss some of the pros and cons of making use of these tools so that you can come to a decision if they are suitable for you.

If you would desire to commence buying and selling ideal away, you can click below to locate much more information on existing selling price quotations.

The most utilised technological examination resources when buying and selling stocks

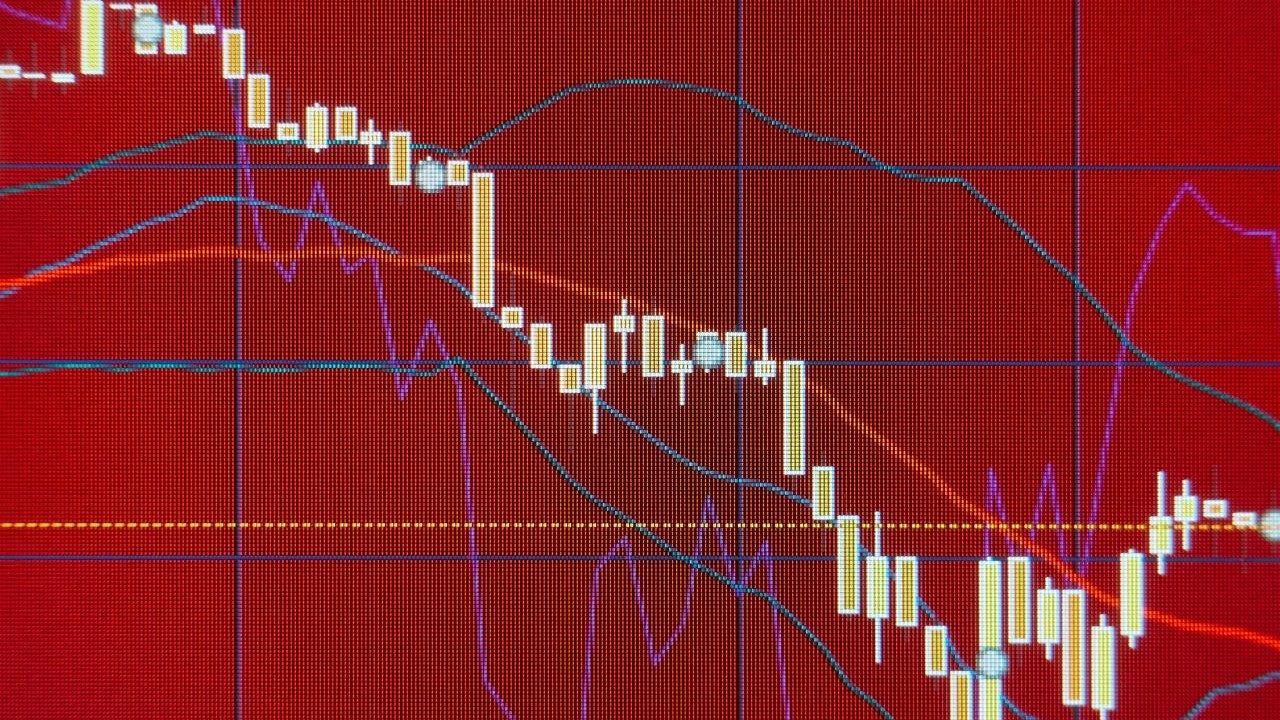

Relocating averages are amid the most very well-appreciated complex analysis devices. Moving averages sleek out cost info around time, so quick-term fluctuations do not obscure more time-time period traits.

There are two most important forms of moving averages: easy and exponential. Straightforward moving averages give equal pounds to just about every piece of value info, even though exponential transferring averages give much more weight to current data factors.

Going averages can be utilized in various techniques, but one everyday use is to support establish assist and resistance stages. These are value concentrations at which a inventory is most likely to come across consumers or sellers. By wanting at how a stock has traded in the past, traders can much better understand wherever these crucial price tag stages are.

Yet another technical investigation resource typically made use of with transferring averages is Bollinger Bands. Bollinger Bands are higher and decrease value boundaries put about a shifting typical.

The notion driving Bollinger Bands is that rates tend to keep within these boundaries most of the time but will at times split out to new highs or lows. By working with shifting averages and Bollinger Bands, traders can better comprehend when a stock is thanks for a price transfer.

Several other technical assessment equipment are offered to traders, but these are two of the most well-known. As you develop into a lot more common with the stock market, you might use extra technical indicators to make trading choices.

On the other hand, it is crucial to don’t forget that no indicator is ideal. Technical investigation instruments can give you a better sense of when a inventory is thanks for a value go, but they can not notify you exactly when that go will take place.

The pros and drawbacks of applying stock buying and selling examination equipment

There are a number of pros and negatives to using technological assessment instruments. On the moreover facet, these applications can help you become a much more knowledgeable trader. They can also assistance you place probable trading alternatives you might have skipped. Having said that, there are a number of downsides to making use of these indicators as well.

One downside is that specialized analysis instruments can normally confuse new traders. There is a ton of jargon and math, making it hard to comprehend what you are wanting at. If you are beginning in the stock industry, you may perhaps want to adhere with a lot more apparent indicators like moving averages right up until you get a much better feel for how the marketplace will work.

Total, specialized assessment tools can significantly incorporate to your stock current market arsenal. They can help you develop into a much more educated trader and location probable trading chances.

Nonetheless, they should really not be applied blindly. As with nearly anything in the inventory current market, it is essential to do your investigate and always use these instruments sensibly.

What are some other things inventory traders should really be informed of?

About investing stocks, there are lots of components that traders need to be conscious of past technological analysis. A person important factor to continue to keep in thoughts is the all round current market craze.

Is the current market at this time in a bull current market (charges rising) or a bear industry (charges falling)? It can substantially affect whether or not you want to invest in or sell a distinct inventory.

A further essential element to think about is the company’s financial wellbeing. Is the enterprise earning dollars or dropping money? Reading through the money data of the organization will supply you with this info.

Eventually, it is also crucial to pay out interest to information gatherings that could possibly have an effect on the inventory selling price. For occasion, when a organization introduces a new product, this could cause the inventory selling price to increase. On the other hand, a company struggling with a lawsuit could induce the stock selling price to slide.

Why specialized evaluation resources are critical for stock traders

Technological investigation can be a practical device for inventory traders, but it is important to remember that no indicator is excellent.

Specialized indicators can give you a superior feeling of when a stock is due for a value transfer, but they can not inform accurately when that go will take place. In the end, working with your judgement when creating buying and selling decisions is always crucial.

I am Adeyemi Adetilewa, a media expert, entrepreneur, husband, and father. Founder and Editor-In-Chief of Concepts Furthermore Small business Magazine, on line small business assets for business owners. I assistance makes share special and impactful stories through the use of general public relations, promotion, and on line advertising and marketing. My work has been featured on the Huffington Put up, Prosper International, Addicted2Achievements, Hackernoon, The Fantastic Men Challenge, and other publications.