3 Reasons Why Big Oil Is A Buy After A Punishing Pullback

Formerly a sell, the current huge drop in crude has designed Major Oil a acquire. How to position to profit from ongoing consolidation in XOM stock.

shutterstock.com – StockNews

A minimal around a thirty day period back, I wrote about why I assumed oil and oil shares were a limited in “5 Good reasons Why It can be Last but not least The Time To Provide Large Oil“. The fundamentals, technicals, and implied volatility had been all having to extremes. Chances favored a pullback.

Now that oil and oils shares have fallen in excess of 15% in the previous 30 times, my opinion has changed as well. Price tag does issue. My prior bearish outlook has turned to a far more neutral to a little bullish viewpoint. Let’s look at three explanations why the worst might be in excess of for the current carnage in crude. Once yet again, I will be employing ExxonMobil (XOM) as the poster child for Major Oil.

Fundamentals

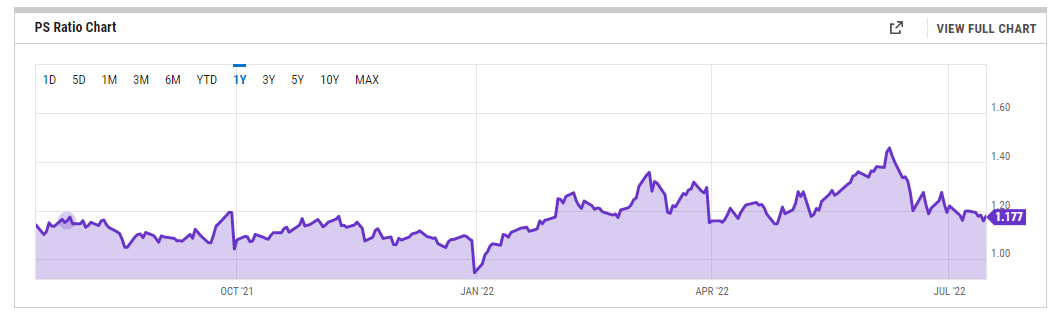

ExxonMobil inventory was trading around traditionally wealthy valuations past month. P/S was about 1.4x back again then and at by considerably the richest several of the prior 12 months. Now that XOM has cratered from the highs, valuations are substantially far more desirable. Recent P/S ratio stands at below 1.18x and nearing the lowest numerous in the previous 5 months.

Other conventional essential metrics such as P/E and P/FCF show a comparable drop. The present-day P/E stands at just in excess of 14x and is at a price cut to the 10-year typical of 15.23X. Analysts are expecting ExxonMobil to reward drastically from the improved refining margins and upped the FY 2022 earnings estimates to in excess of $11.50 for each share. This equates to a ahead P/E of below 8-which ought to commence to attract price buyers.

Technicals

ExxonMobil arrived at oversold readings before ultimately bouncing. 9-working day RSI breached 30 then turned greater. MACD hit a annually reduced right before strengthening significantly. Bollinger P.c B went destructive but has since returned to positive territory. XOM inventory was investing at a significant lower price to the 20-day shifting regular. Shares bounced off major for a longer period-time period assistance at $82 as soon as all over again.

Prior periods all these indicators aligned in a related trend marked substantial lows in ExxonMobil stock. The point that it happened at a big assist stage tends to make it an even extra strong indicator.

Implied Volatility

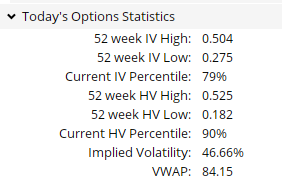

Past thirty day period XOM inventory option price ranges were being alternatively low cost. Implied volatility (IV) was trading at just the 34th percentile. The punishing pullback, nonetheless, has pushed IV up sharply. Present-day IV now stands at the 79th percentile. This signifies selections prices have long gone from fairly inexpensive to rather high priced-favoring alternative providing in excess of choice purchasing when developing trades.

Spikes in IV are also numerous times a responsible bullish opposite indicator. Imagine about how huge pops in the VIX have several situations been a sign that the anxiety is at an serious and the lows are suitable all around the corner.

How To Trade It Now

A thirty day period in the past, I encouraged wanting at buying places on XOM as an helpful way to place for a pullback. Shares had been overvalued, overbought and IV was low cost. That trade would have worked out nicely offered the subsequent massive fall in ExxonMobil shares.

Now, on the other hand, ExxonMobil is wanting way superior from a valuation viewpoint. Shares are receiving oversold. Option price ranges have gotten a lot far more costly. So alternatively of getting puts to place for a pullback, providing puts (or place spreads for reduce hazard traders) is the best way to income in from ongoing consolidation about the major aid place at $82.

Legendary trader Paul Tudor Jones has a stating: “Adapt, evolve, compete, or die”. In this market environment the capacity to adapt to swiftly shifting sector disorders and evolve your investing technique is even much more vital.

POWR Choices

What To Do Following?

If you’re hunting for the most effective solutions trades for present day market, you must verify out our latest presentation How to Trade Choices with the POWR Rankings. Below we demonstrate you how to constantly discover the best choices trades, whilst minimizing chance.

If that appeals to you, and you want to find out much more about this impressive new choices tactic, then click on under to get access to this timely expenditure presentation now:

How to Trade Options with the POWR Ratings

All the Greatest!

Tim Biggam

Editor, POWR Solutions E-newsletter

XOM shares closed at $84.54 on Friday, up $1.40 (+1.68%). Year-to-date, XOM has gained 41.12%, compared to a -18.31% rise in the benchmark S&P 500 index in the course of the very same interval.

About the Creator: Tim Biggam

Tim spent 13 a long time as Chief Possibilities Strategist at Person Securities in Chicago, 4 many years as Direct Possibilities Strategist at ThinkorSwim and 3 several years as a Marketplace Maker for Initial Options in Chicago. He can make frequent appearances on Bloomberg Television set and is a weekly contributor to the TD Ameritrade Community “Morning Trade Dwell”. His overriding enthusiasm is to make the complicated environment of solutions extra understandable and thus additional valuable to the daily trader. Tim is the editor of the POWR Selections e-newsletter. Learn far more about Tim’s track record, along with back links to his most current articles.

The post 3 Motives Why Massive Oil Is A Acquire Right after A Punishing Pullback appeared to start with on StockNews.com