Bitcoin (BTC) Will Need to Return to $30,000 to Avoid a Sunday Reversal

Table of Contents

Important Insights:

-

On Saturday, bitcoin rose by .56% to log a sixth daily acquire from 8 sessions.

-

Negative chatter around crypto laws and market sentiment toward Fed monetary plan pegged bitcoin again from a more materials gain.

-

Bitcoin (BTC) specialized indicators continue being bearish, with bitcoin sitting down at the 100-working day EMA.

On Saturday, bitcoin (BTC) rose by .56%. Partly reversing a 2.50% drop from Friday, bitcoin finished the day at $29,845.

A bearish start out saw bitcoin fall to an early early morning low of $29,467 in advance of locating assistance.

Steering crystal clear of the day’s Important Aid Concentrations, bitcoin struck an afternoon intraday substantial of $29,954.

Slipping brief of the To start with Main Resistance Degree at $30,488, nonetheless, bitcoin slipped again into the purple ahead of a late recovery.

Saturday’s upside came inspite of the US nonfarm payroll figures on Friday, which supported a a lot more intense Fed desire level path trajectory.

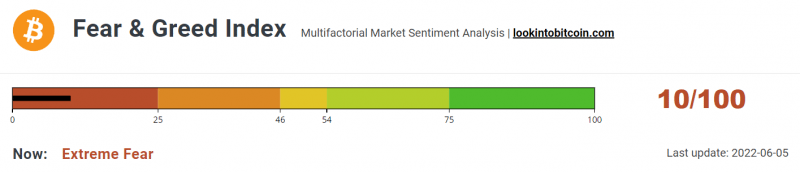

The Bitcoin Anxiety & Greed Index Sits Deep in the Excessive Anxiety Zone

Now, the Dread & Greed Index fell from 14/100 to 10/100 even with bitcoin’s Saturday gain and the prospect of ending a 9-7 days losing streak.

While slipping further into the “Extreme Fear” zone, the Index continued to keep earlier mentioned May’s small of 8/100.

Regulatory chatter was sector adverse, with regulators and lawmakers contacting for better oversight.

Going into the weekend, Governor Christopher J. Waller talked about “Risk in the Crypto Marketplaces.”

The governor talked of large volatility currently being the rule and not the exception and the frequent occurrence of fraud and theft.

Waller also centered on retail users with a lack of crypto encounter and the require for some typical guidelines.

South Korean lawmakers ended up also energetic heading into the weekend. In accordance to nearby media, regulators plan to transfer outside of the Funds Marketplaces Act pursuing the collapse of TerraUSD (UST) and Terra LUNA.

Bitcoin (BTC) Cost Action

At the time of composing, BTC was down .45% to $29,712.

A array-bound start to the working day saw bitcoin increase to an early early morning large of $29,882 right before falling to a minimal of $29,712.

Technical Indicators

BTC will need to have to go back by way of the $29,754 pivot to target the Very first Major Resistance Level at $30,045.

BTC would require the broader crypto current market to help to break out from Saturday’s superior of $29,954.

An extended rally would exam the Next Main Resistance Amount at $30,241 and resistance at $30,500. The Third Key Resistance Level sits at $30,728.

Failure to shift back again as a result of the pivot would check the 1st Important Assistance Amount at $29,554. Barring one more extended offer-off, BTC should really steer clear of sub-$29,000 levels. The 2nd Important Assistance Stage at $29,267 must limit the downside.

On the lookout at the EMAs and the 4-hourly candlestick chart (under), it is a bearish signal. Bitcoin sits under the 50-day EMA, at this time at $30,051. The 50-day pulled back from the 100-day EMA. The 100-working day EMA slipped back again from the 200-working day EMA BTC adverse.

A transfer as a result of the 100-working day EMA, now at $30,260, would help a operate at $31,000.

This short article was originally posted on Fx Empire