Could ESOPs Be The Solution For Employee Retention?

Table of Contents

Employee-owned businesses have experienced significantly fewer issues with employee retention than their non-employee-owned counterparts. I can’t remember a time in my career when employee retention was talked about more often than it is now. Even personally, I’m one of those Great Resignation statistics. In late 2021, I resigned my position in local government to take on the role of Executive Director of Missouri Center for Employee Ownership, Inc. (MOCEO). Like many members of the American workforce, the pandemic pushed me to reevaluate my personal and professional priorities. So, when I joined MOCEO, I was very interested to learn what effect employee ownership had on employee retention. So, as soon as my second week of work, I began asking every executive of an employee-owned business I met, how their business model impacted retention. With very few exceptions, the general response is that retention wasn’t a significant issue.

Learn More About ESOPs with select sessions at our 30th Annual Great Game of Business Conference

What is employee ownership?

First, for those who might not be familiar with the concept, employee ownership means the business has adopted one of several options of providing employees with some type of ownership of the business. The most popular model is Employee Stock Ownership Plans, or ESOPs. Business owners of c-corps or s-corps, typically with at least 20 employees, become an ESOP by selling their business to a qualified disbursement account, which functions like a trust. The retirement plan then owns the business, still managed by a traditional board and management team, and then distributes shares of the business to employees based on a prescribed plan at no cost to the employees as a benefit of their employment. Such a transaction produces tax advantages for the business, such as tax deferment, and gives employees the opportunity for business ownership. You can read more about ESOPs from MOCEO or NCEO.

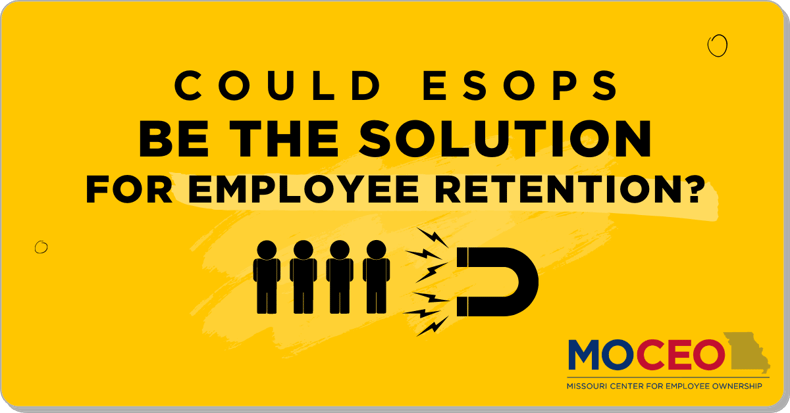

Several organizations have already established the fact that employee-owned businesses retain employees more effectively than non-employee-owned businesses. Here’s just a quick sample of the data, conducted by the National Center for Employee Ownership and Rutgers University.

Even during the pandemic, ESOPs fared better. In fact, according to one study out of Rutgers University, ESOPs retained jobs at a 4 to 1 rate compared to non-employee-owned counterparts and maintained normal hours and operations at a significantly higher rate as well.

Why are employee-owned companies outperforming their counterparts? Well, when you look at industry best practices around retention, employee ownership brings a lot to the table to address the leading contributors to job satisfaction. Five of the key contributors to job satisfaction, according to the Society for Human Resource Management, are highlighted below, along with the ways in which employee ownership addresses each category.

Respectful treatment of all employees at all levels

No surprise here, but when people don’t feel like they are valued or like their colleagues are valued, they’re not likely to stay around. Of the five categories, this is the one hardest to determine the role being employee-owned plays. If you have a toxic work culture and then become an ESOP, you’ll be an ESOP with a toxic work culture. However, since employee ownership often comes at the motivation of a business owner who cares for his or her employees, ESOPs are often known for their positive work cultures.

That being said, if the Great Resignation has revealed anything, it’s that the workforce is choosing to work where they feel valued. If mutual respect and value is the biggest issue your organization is facing, you should look to address that before considering an employee ownership model. The Great Game Team gives some advice on where you should focus your attention.

If you already have this positive culture, aspects of an ESOP can definitely foster it. Employee owners have natural buy-in to the success of the organization and are more likely to understand how their behavior impacts the organization’s profitability and, in turn, their own retirement. Additionally, many ESOPs have cross-functional teams that work to improve and maintain a positive work environment as new employees come on board.

Compensation/pay

I’ve always been surprised by the extent to which this contributor to employee satisfaction is debated. Compensation matters to employees. However, it’s not usually about sign-on bonuses, retention bonuses, or simple pay raises. The real conversation is around two different questions: 1) Am I being compensated fairly in relation to peers both inside and outside the organization? And 2) Am I making enough money to take care of my personal or family needs? Employee ownership can help answer both of these questions in the affirmative, especially when paired with open-book management.

First, employee-owners tend to make more than their counterparts. Like the infographic above explains, the median household income of employee owners at ESOPs is 33% higher than traditional employees.

Secondly, businesses are often used to providing retirement benefits such as 401ks. Comparatively, ESOPs provide increased benefits. Employees have a more direct impact on the value of their shares than they do in a traditional 401k and the value of those shares can increase at a greater rate. While each ESOP’s plan is slightly different, most include the responsibility of the company to buy back the shares of any employee-owners who leave the company or retire, usually over a number of years.

In addition to the retirement benefits, many ESOPs also have well-developed bonus structures based on organizational performance. Check out this guide on bonuses from the Great Game Team.

Business ownership itself is a form of compensation. Business ownership is the single most important driver of personal wealth, and ESOPs give individuals who otherwise would often not have an opportunity to own a business the chance to develop this wealth, which can lead to generational impacts. Thomas Dudley recently visited with The ESOP Guy on his podcast, highlighting the potential for ESOPs to close the wealth gap for nearly every demographic of American worker. If an ESOP were to decide to sell in a strategic acquisition, the employee-owners get the benefits of that sale. Just last month Clif Bar & Company, 20% of which was owned by an ESOP, sold to Mondelez for $2.9 billion. 1,300 employee-owners will get paid out their portions of the $580 million that will go to the ESOP. While the distribution of that payout will be based on the specifics of their ESOP plan, such as tenure with the company, that averages to approximately $500,000 per individual.

Trust between employees and senior management

The pandemic did an unexpected number on trust between employees and senior management that’s easy to overlook. I spoke with several employees from an organization in the Kansas City area with about 350 employees that saw these challenges first hand. Before the pandemic, the business was well known for its positive work-culture, but the pandemic changed that. Since the organization relied on face-to-face interactions with their consumers for almost all of their daily business, they had to make significant changes in the blink of an eye when the pandemic first struck. The employees felt like the organization had changed from a good place to work to a dictatorship overnight because executive leadership was making decisions for paradigm-shifting changes and expecting them to be implemented within hours without input from any front-line or management staff. The executive leadership, on the other hand, felt like the employees were being oversensitive and complaining too much because they weren’t responding well to the shifts the organization had to make in order to stay open and conduct business. There were likely other contributing factors, but at one point 25% of the positions with the organization were vacant at the same time, which of course snowballed because the other 75% were still having to do 100% of the work which led to additional burnout and retention issues.

Business leaders can’t go back and change the way they made decisions at the beginning of the pandemic, but they can consider if there were decisions made in the last three years that would have eroded trust. Many ESOPs employ strategies to provide two-way communication between senior leaders and employee owners, ensuring that employees have the opportunity to share their ideas, senior leaders can be open about strategic changes, and employee owners can provide feedback once changes are implemented. When there is a crisis, such as the pandemic, it’s natural for leaders to take charge and make decisions with less of the traditional feedback loops. However, since ESOPs have some of these communications channels already operationationalized before a crisis, they can be more effective at using them during a crisis as well. This gives leadership both the chance to reduce the erosion of trust in the first place and a pathway to repair it when broken trust does occur.

One of the biggest misconceptions about employee ownership is that it’s impossible to lead because all the employees get to vote on all the decisions of the business. This isn’t the case, though. There is still a clear management structure in an ESOP, and the employee-owners don’t manage the day-to-day activity of the business. Leaders of ESOPs had to make some of the same difficult decisions during the pandemic as non-employee-owned businesses. But as the data above demonstrated, they were able to do so without losing as many employees.

Job security

We all depend on our jobs to take care of our personal and family needs. So uncertainty about the future of our position increases anxiety, decreases productivity, and drives talent to look for more dependable places to work. Early on in my career, I left a job I enjoyed for a position with a higher salary (I was answering the question: does my compensation meet my family’s needs? And the answer was “no.”). After a few months in the new role, my old employer asked me to come back into a management role that would meet my family’s needs. I was excited to return. However, in the few short months I was gone, the executive leadership for the organization had changed and some reorganization was beginning to take place. The workplace culture felt very different than when I had been there a few months before, and had shifted to an environment where people were afraid they would lose their jobs. There weren’t any significant layoffs going on, and a lot could have been done to communicate better. However, many of my colleagues were hesitant to make decisions or take risks until the dust settled and that fear came up regularly in team and department meetings. The reality is that when an employee is concerned about losing their job, they aren’t able to focus on being productive in their position. If the risk of losing the job is real and high, it’s likely that employees are using their work time to apply for other positions already.

We all depend on our jobs to take care of our personal and family needs. So uncertainty about the future of our position increases anxiety, decreases productivity, and drives talent to look for more dependable places to work. Early on in my career, I left a job I enjoyed for a position with a higher salary (I was answering the question: does my compensation meet my family’s needs? And the answer was “no.”). After a few months in the new role, my old employer asked me to come back into a management role that would meet my family’s needs. I was excited to return. However, in the few short months I was gone, the executive leadership for the organization had changed and some reorganization was beginning to take place. The workplace culture felt very different than when I had been there a few months before, and had shifted to an environment where people were afraid they would lose their jobs. There weren’t any significant layoffs going on, and a lot could have been done to communicate better. However, many of my colleagues were hesitant to make decisions or take risks until the dust settled and that fear came up regularly in team and department meetings. The reality is that when an employee is concerned about losing their job, they aren’t able to focus on being productive in their position. If the risk of losing the job is real and high, it’s likely that employees are using their work time to apply for other positions already.

ESOPs are popular in industries like manufacturing, technical services, construction, and finance, some of which are naturally prone to significant employee layoffs. Employee owners in ESOPs though are 6 times less likely to be laid off than traditional employees. They provide natural, built-in job security. Additionally, when paired with financial literacy of the business, employee-owners have a better understanding of how their role fits into the company as a whole, which decreases fear about job stability.

Opportunities to use their skills and abilities at work.

The idea that “unleashing employees to do what they do best every day helps with retention,” isn’t new. Gallup has been writing about the fact for decades, and having an ownership mindset naturally brings that to the table. I love Great Game’s understanding that ownership isn’t a legal status, it’s a frame of mind. A company doesn’t have to be an ESOP in order to foster an ownership mindset from its employees, but a company where the employees actually are owners sure doesn’t hurt. In the entrepreneurship and startup space, business partners often get together because they have different skill sets that are needed to make the business a success. This is a natural approach to business ownership, and ESOPs naturally expand the concept to the entire workforce.

Many ESOPs utilize cross-functional workgroups and regular team meetings naturally geared towards getting employee engagement in the management and productivity of the business. I have heard countless stories of how this has benefits both the employee base and the company as a whole, including employee-driven ideas that have led to business acquisitions, new product lines, and reducing significant overhead costs.

My curiosity continues as I meet management team members from ESOPs about employee retention, but it’s been clear so far that ESOPs have a competitive advantage in the marketplace for a strong and consistent workforce. The ownership mindset combined with actual business ownership increases employee satisfaction with their work relationships and compensation and, because of the added benefit of an ESOP, both the employees and the business get to share in the success and increased profitability.

If anyone is interested in talking more about whether ESOPs might be a good fit for their business, send a quick email to [email protected] for a confidential conversation.

About MOCEO

Missouri Center for Employee Ownership, Inc (MOCEO) is a 501(c)3 nonprofit organization focused on education and advocacy of employee ownership as an exit planning and business retention strategy across Missouri. They are funded through a grant from the Ewing Marion Kauffman Foundation, in partnership with the Great Game of Business and a number of other individuals and organizations, to provide consultation and educational services across Missouri at no cost.

Hear more about ESOPS and employee ownership from industry experts, CEOs, and Great Game of Business coaches at our 30th Annual Great Game of Business Conference. Learn how to pair your ESOP with The Great Game of Business to maximize your ESOP.