Does Macmahon Holdings (ASX:MAH) Have A Healthy Balance Sheet?

Table of Contents

Legendary fund supervisor Li Lu (who Charlie Munger backed) when mentioned, ‘The most significant financial investment chance is not the volatility of costs, but no matter whether you will undergo a long-lasting decline of cash.’ So it appears the intelligent funds is aware that debt – which is typically concerned in bankruptcies – is a quite crucial element, when you evaluate how risky a enterprise is. Importantly, Macmahon Holdings Minimal (ASX:MAH) does have financial debt. But the far more essential problem is: how significantly risk is that financial debt developing?

When Is Financial debt Harmful?

Typically talking, financial debt only will become a serious difficulty when a firm won’t be able to simply pay out it off, possibly by elevating funds or with its very own income move. In the worst situation scenario, a company can go bankrupt if it cannot pay back its creditors. On the other hand, a more popular (but continue to painful) situation is that it has to elevate new equity capital at a minimal price tag, hence forever diluting shareholders. Acquiring reported that, the most widespread condition is where a corporation manages its debt reasonably perfectly – and to its individual edge. The initial phase when contemplating a firm’s financial debt concentrations is to consider its funds and credit card debt with each other.

Check out our most current analysis for Macmahon Holdings

What Is Macmahon Holdings’s Debt?

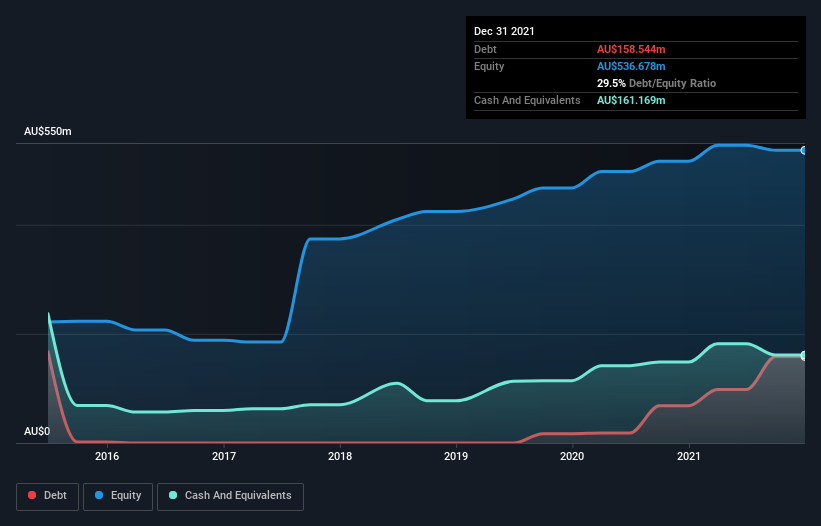

The image underneath, which you can click on on for better depth, displays that at December 2021 Macmahon Holdings experienced credit card debt of AU$158.5m, up from AU$68.3m in one particular calendar year. Nonetheless, it does have AU$161.2m in funds offsetting this, major to internet dollars of AU$2.63m.

A Glance At Macmahon Holdings’ Liabilities

We can see from the most recent harmony sheet that Macmahon Holdings experienced liabilities of AU$408.6m slipping thanks within just a year, and liabilities of AU$305.7m thanks past that. Offsetting this, it had AU$161.2m in income and AU$278.9m in receivables that were because of within 12 months. So its liabilities outweigh the sum of its dollars and (around-term) receivables by AU$274.2m.

This deficit is considerable relative to its industry capitalization of AU$336.2m, so it does propose shareholders really should hold an eye on Macmahon Holdings’ use of debt. This implies shareholders would be closely diluted if the corporation required to shore up its stability sheet in a hurry. Though it does have liabilities worth noting, Macmahon Holdings also has a lot more hard cash than personal debt, so we are fairly confident it can control its debt safely and securely.

Sadly, Macmahon Holdings’s EBIT basically dropped 4.5% in the last 12 months. If earnings continue on on that decline then taking care of that financial debt will be hard like offering sizzling soup on a unicycle. When analysing debt degrees, the balance sheet is the apparent place to get started. But eventually the future profitability of the business enterprise will decide if Macmahon Holdings can strengthen its stability sheet about time. So if you’re concentrated on the upcoming you can check out this totally free report showing analyst financial gain forecasts.

At last, a enterprise can only pay out off financial debt with chilly tricky income, not accounting income. Macmahon Holdings may perhaps have net income on the equilibrium sheet, but it is nonetheless intriguing to glance at how very well the organization converts its earnings right before fascination and tax (EBIT) to free hard cash circulation, mainly because that will affect each its have to have for, and its potential to take care of personal debt. Above the most latest 3 yrs, Macmahon Holdings recorded no cost income stream worthy of 77% of its EBIT, which is about ordinary, provided free of charge hard cash flow excludes curiosity and tax. This free of charge funds flow puts the corporation in a great posture to fork out down debt, when proper.

Summing up

Whilst Macmahon Holdings’s harmony sheet isn’t especially powerful, thanks to the whole liabilities, it is clearly favourable to see that it has web funds of AU$2.63m. And it impressed us with free of charge hard cash flow of AU$41m, remaining 77% of its EBIT. So we really don’t have any difficulty with Macmahon Holdings’s use of credit card debt. The stability sheet is evidently the region to target on when you are analysing financial debt. On the other hand, not all investment decision threat resides in the balance sheet – significantly from it. Situation in place: We have spotted 2 warning indicators for Macmahon Holdings you should be informed of.

If you’re intrigued in investing in enterprises that can expand gains without having the stress of credit card debt, then check out out this absolutely free record of expanding businesses that have net income on the harmony sheet.

Have feed-back on this write-up? Worried about the articles? Get in contact with us directly. Alternatively, e mail editorial-team (at) simplywallst.com.

This write-up by Only Wall St is common in nature. We deliver commentary primarily based on historic knowledge and analyst forecasts only applying an impartial methodology and our content articles are not meant to be money assistance. It does not constitute a suggestion to invest in or sell any inventory, and does not acquire account of your goals, or your economical predicament. We purpose to carry you extensive-phrase focused assessment pushed by fundamental information. Notice that our analysis may not issue in the most recent cost-sensitive firm bulletins or qualitative materials. Simply just Wall St has no situation in any stocks pointed out.