Is Resources Connection (NASDAQ:RGP) A Risky Investment?

Table of Contents

David Iben put it perfectly when he mentioned, ‘Volatility is not a chance we care about. What we care about is avoiding the lasting loss of money.’ When we assume about how dangerous a enterprise is, we often like to seem at its use of credit card debt, since personal debt overload can direct to destroy. We note that Resources Connection, Inc. (NASDAQ:RGP) does have credit card debt on its equilibrium sheet. But really should shareholders be anxious about its use of personal debt?

When Is Personal debt A Difficulty?

Debt and other liabilities become risky for a organization when it can’t simply satisfy those people obligations, possibly with no cost dollars flow or by boosting money at an desirable price tag. Finally, if the organization are unable to fulfill its lawful obligations to repay credit card debt, shareholders could stroll absent with nothing at all. On the other hand, a extra popular (but even now painful) situation is that it has to increase new equity cash at a small cost, thus permanently diluting shareholders. Of training course, lots of businesses use financial debt to fund progress, without any damaging effects. The very first thing to do when contemplating how significantly personal debt a business enterprise utilizes is to glimpse at its funds and personal debt jointly.

Verify out our most recent analysis for Means Connection

What Is Resources Connection’s Personal debt?

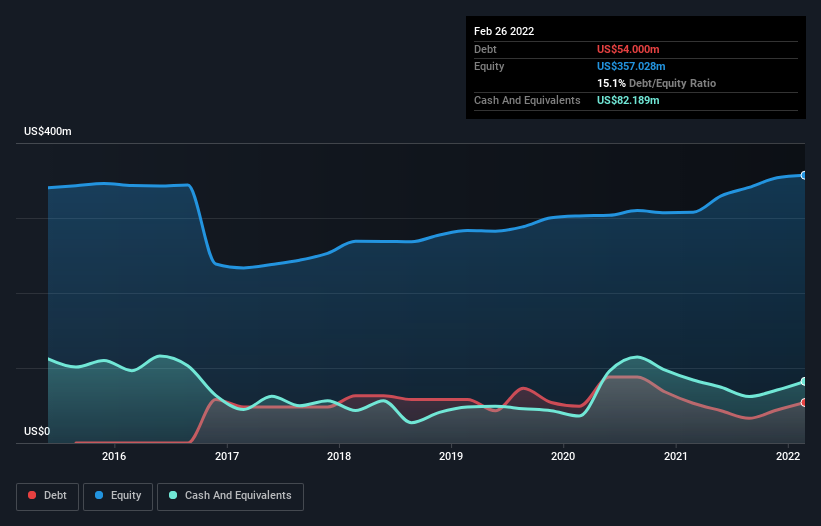

As you can see beneath, Resources Connection had US$54.0m of financial debt, at February 2022, which is about the similar as the year prior to. You can simply click the chart for bigger detail. But on the other hand it also has US$82.2m in funds, top to a US$28.2m web cash situation.

How Sturdy Is Resources Connection’s Equilibrium Sheet?

In accordance to the previous claimed equilibrium sheet, Methods Connection had liabilities of US$115.6m owing within 12 months, and liabilities of US$87.1m because of past 12 months. Offsetting this, it had US$82.2m in funds and US$187.7m in receivables that had been owing in just 12 months. So it can boast US$67.2m extra liquid belongings than whole liabilities.

This surplus implies that Methods Link has a conservative harmony sheet, and could in all probability reduce its debt with out considerably issue. Just place, the simple fact that Methods Relationship has additional dollars than credit card debt is arguably a fantastic indication that it can regulate its financial debt safely.

Even a lot more remarkable was the point that Means Connection grew its EBIT by 131% in excess of twelve months. That enhance will make it even much easier to pay down debt likely forward. The equilibrium sheet is evidently the place to concentrate on when you are analysing financial debt. But it is upcoming earnings, more than something, that will figure out Sources Connection’s means to keep a wholesome equilibrium sheet heading forward. So if you are concentrated on the future you can check out out this totally free report exhibiting analyst profit forecasts.

At last, whilst the tax-person could adore accounting income, lenders only accept chilly tricky funds. Assets Connection may perhaps have web income on the harmony sheet, but it is continue to attention-grabbing to look at how perfectly the company converts its earnings before curiosity and tax (EBIT) to cost-free income move, mainly because that will influence both equally its want for, and its capability to handle credit card debt. During the previous 3 several years, Resources Connection created free of charge cash move amounting to a extremely robust 89% of its EBIT, far more than we’d be expecting. That positions it properly to pay back down debt if fascinating to do so.

Summing up

When we empathize with traders who locate financial debt concerning, you really should continue to keep in head that Methods Link has web money of US$28.2m, as perfectly as much more liquid property than liabilities. And it impressed us with totally free money stream of US$24m, currently being 89% of its EBIT. So we will not feel Means Connection’s use of personal debt is dangerous. The harmony sheet is plainly the spot to focus on when you are analysing personal debt. On the other hand, not all expenditure possibility resides inside of the harmony sheet – significantly from it. These dangers can be difficult to location. Each corporation has them, and we have spotted 1 warning indication for Assets Relationship you really should know about.

At the finish of the day, it is normally better to focus on corporations that are absolutely free from net personal debt. You can accessibility our special record of such organizations (all with a keep track of history of profit progress). It’s totally free.

Have responses on this write-up? Worried about the content material? Get in contact with us directly. Alternatively, e-mail editorial-crew (at) simplywallst.com.

This report by Merely Wall St is common in character. We supply commentary centered on historic data and analyst forecasts only working with an impartial methodology and our article content are not meant to be economical advice. It does not constitute a suggestion to obtain or promote any stock, and does not take account of your targets, or your money problem. We goal to carry you long-expression concentrated analysis pushed by basic knowledge. Be aware that our investigation may not aspect in the most current cost-sensitive business announcements or qualitative product. Just Wall St has no position in any shares talked about.