Principal Financial (PFG) Q1 Earnings Beat, Increase Y/Y

Table of Contents

Principal Financial Group, Inc.’s PFG first-quarter 2022 operating net income of $1.63 per share beat the Zacks Consensus Estimate by 7.9%. Also, the bottom line increased 6.5% year over year.

Principal Financial witnessed higher revenues across most of its business lines and higher assets under management (AUM), offset by higher expenses.

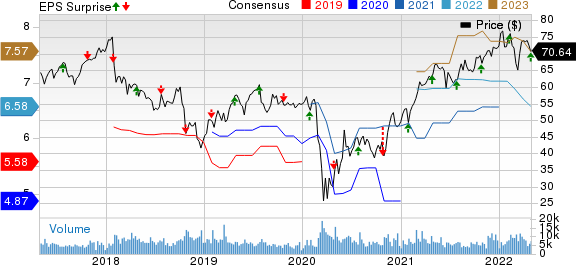

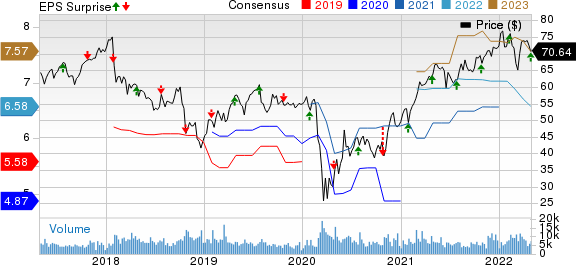

Principal Financial Group, Inc. Price, Consensus and EPS Surprise

Principal Financial Group, Inc. price-consensus-eps-surprise-chart | Principal Financial Group, Inc. Quote

Behind the Headlines

Operating revenues increased 5.1% year over year to $3.3 billion due to increased premiums and other considerations, higher net investment income and fees and other revenues. The top line missed the Zacks Consensus Estimate by 10.7%.

Total expenses increased 3.4% year over year to $2.7 billion due to higher benefits, claims and settlement expenses and dividends to policyholders.

Principal Financial’s AUM as of Mar 31, 2022 amounted to $714.3 billion, up 7.5% year over year.

Segment Update

Retirement and Income Solution: Revenues increased nearly 4.8% year over year to about $1.3 billion due to higher premiums and other considerations, higher fees and other revenues and net investment income.

Pre-tax operating earnings increased 10.4% year over year to $317.9 million on account of higher net revenues and lower operating expenses.

Principal Global Investors: Revenues of $435.3 million were up 4.8% from the prior-year quarter driven by higher fees and other revenues.

Pre-tax operating earnings increased 1.2% year over year to $143.4 million due to higher operating revenues less pass-through expenses, partially offset by higher operating expenses.

Principal International: Revenues increased 2.2% year over year to $314.9 million in the quarter due to higher net investment income.

Operating earnings decreased 22.6% year over year to $58.1 million due to lower combined net revenues.

U.S. Insurance Solution: Revenues grew 5.6% year over year to $1.2 billion, driven by higher premiums and other considerations, net investment income, fees and other revenues.

Operating earnings of $115.8 million increased 21.6% year over year, mainly due to improved performance at the Specialty Benefits Insurance business and Individual Life Insurance.

Corporate: Operating loss of $129 million was wider than $93.8 million loss incurred a year ago. This downside was due to unfavorable variable investment income and higher operating expenses.

Financial Update

As of Mar 31, 2022, cash and cash equivalents were $2.7 billion, up 36.8% year over year.

At first-quarter end, debt was $4.3 billion, up 0.02% year over year.

As of Mar 31, 2022, book value per share (excluding AOCI other than foreign currency translation adjustment) was $49.19, up 2.4% year over year.

Dividend and Share Repurchase Update

Principal Financial paid out $167 million in dividends and deployed $724.4 million to buy back 10.8 million shares in the quarter under review.

The board of directors approved second-quarter dividend of 64 cents per share. The dividend will be paid out on Jun 24, 2022, to shareholders of record as of Jun 2, 2022.

Zacks Rank

Principal Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Ameriprise Financial’s AMP first-quarter 2022 adjusted operating earnings per share of $5.98 surpassed the Zacks Consensus Estimate of $5.93. The bottom line reflects a rise of 10% from the year-ago quarter.

Adjusted operating expenses totaled $2.8 billion, up 11% from the prior-year quarter. Driven by solid client flows in the Advice & Wealth and the Asset Management segments, total AUM and AUA were $1.34 trillion, up 17% year over year.

SEI Investments Co.’s SEIC first-quarter 2022 earnings of $1.36 per share were in line with the Zacks Consensus Estimate. The bottom line reflected a 53% jump from the prior-year quarter. Net income was $190.3 million, surging 47% from the year-ago quarter. Operating income jumped 62% to $214.8 million.

As of Mar 31, 2022, AUM was $385.3 billion, reflecting a marginal rise from the prior-year quarter. Client assets under administration (AUA) were $899.6 billion, up 8%. Client AUA did not include $13.3 billion related to funds of funds assets reported on Mar 31, 2022.

T. Rowe Price Group, Inc. TROW delivered first-quarter 2022 adjusted earnings per share of $2.62, which missed the Zacks Consensus Estimate of $2.76. The reported figure also declined 13% year over year.Net income attributable to T. Rowe Price was $567.9 million compared with $749.4 million recorded in the prior-year quarter.

Net revenues in the first quarter increased 2% to $1.86 billion from the year-ago quarter’s figure. The upswing primarily resulted from higher administrative, distribution and servicing fees, offset by lower investment advisory fees. Investment advisory fees fell 1.5% year over year to $1.66 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

SEI Investments Company (SEIC) : Free Stock Analysis Report