Seeking High-Upside and Dividend-Yielding Stocks? JMP Suggests 2 Stocks to Buy

The common retail investor, wanting for some toward earnings in today’s perplexing sector natural environment, can ordinarily select 1 of two primary methods. The very first is the traditional stock current market path, that of share appreciation, though the 2nd is the safer, much more defensive, route as a result of dividend payers. But what if an investor doesn’t need to have to opt for among these routes?

According to JMP Securities, there just may well be these kinds of a dual system out there for buyers, correct now, in the kind of substitute asset management organizations. These are ordinarily little- to mid-cap companies, providing funding and cash obtain services to little organization and mid-sized enterprises, a sector that has customarily pushed innovation and position creation in the US overall economy. As JMP’s Brain McKenna writes in a current market be aware, “The choice asset administration market has been one of (if not) the speediest-rising segments in monetary solutions, pushed by a confluence of highly effective secular tailwinds…”

McKenna also dives into the inner performs of quite a few option asset professionals. We’ve made use of the TipRanks platform to pull up the information on two of his picks. According to the JMP look at, both equally of these stocks could deliver a mixture of substantial funds gains and dividend income – earning them a potential double-fisted payday for buyers. Let’s consider a nearer seem.

Blue Owl Money (OWL)

We are going to start off with Blue Owl Funds, a foremost service provider of capital remedies in the private market place. The firm features its companies via 3 direct-loan provider subsidiaries, Owl Rock, Oak Tree, and Dyal Funds. Functioning via these lenders, Blue Owl has over $102 billion in assets below management, and oversees its operations as a result of 9 workplaces in North America, Europe, and Asia.

Blue Owl shaped final yr, through a SPAC transaction that was accomplished in May well. The settlement, which experienced been permitted by the suitable corporations in March, saw the blend of Owl Rock and Dyal Funds with Altimar Acquisition Corporation. Blue Owl’s ticker started off buying and selling publicly on May possibly 20, 2021, and the company had $52.5 million in AUM as of that date.

In the 1st quarter of this calendar year, Blue Owl reported potent raises in its business enterprise. The company’s total AUM, referenced over at $102 billion, represents a 76% year-over-12 months gain, although its retail fundraise growing by 172% y/y, to attain $2.2 billion. These good gains in total capital underlie Blue Owl’s strengths.

In addition, having a lot of cash makes it simple for Blue Owl to pay out out its dividend. The company declared a widespread-share payment of 10 cents for 1Q22, a payment that annualizes to 40 cents and offers a generate of 3.2%. Blue Owl has only been paying its dividend for the earlier four quarters – but it has raised the payment twice in that time.

Initiating coverage of OWL for JMP, analyst Brian McKenna likes what he sees in the company’s potential clients for ongoing advancement. He writes, “In the market right now, there aren’t lots of firms that check all of these bins: a) significant-progress, FRE-centric model b) the extensive the vast majority of AUM is perpetual (long term) and c) a money-light-weight design that returns a big portion of earnings to shareholders through dividends. That explained, Blue Owl is one particular option supervisor that does verify all of these containers, and we imagine its enterprise (and stock) is positioned to outperform more than the extended expression given these dynamics.”

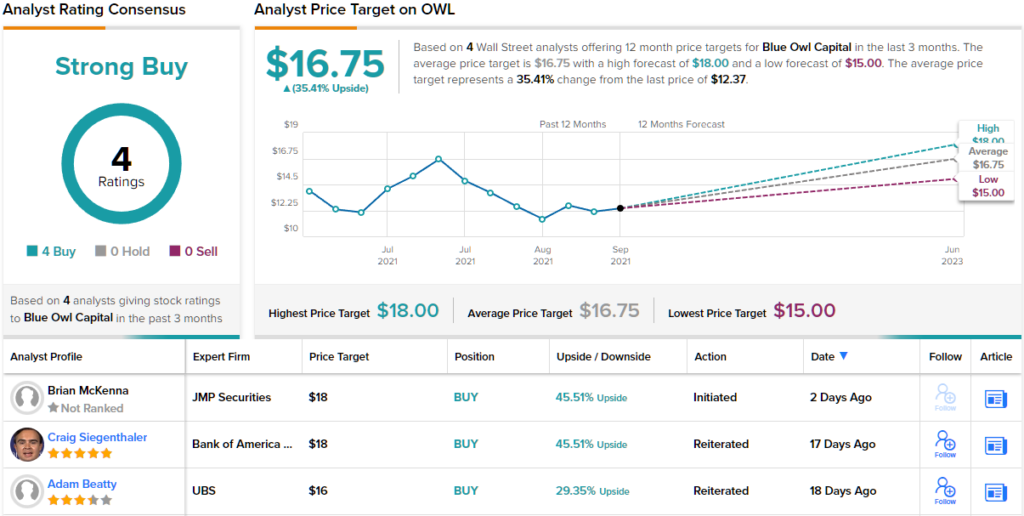

A organization with these an upbeat outlook on returns really should get a stable reference, and McKenna puts an Outperform (i.e. Get) ranking on the stock. His selling price target, of $18, implies a one particular-yr upside prospective of ~45%.

JMP is barely the only investment decision agency putting a audio rating on OWL shares. The stock has a unanimous Solid Acquire consensus watch, dependent on 5 modern constructive analyst critiques. Shares are priced at $12.37 and their $16.75 ordinary selling price goal signifies a 35% upside prospective in the year forward. (See OWL inventory forecast on TipRanks)

Carlyle Group (CG)

Next up is Carlyle Team, a financial expert services organization with company in the multinational private fairness and asset administration sectors. Carlyle has 26 workplaces close to the globe, by which it manages some $325 billion in complete assets. The company’s business enterprise segments consist of world wide non-public equity, international credit rating, and global financial investment options.

World wide financial investment alternatives is the smallest of the segments, accounting for $65 billion of the total property beneath administration. Worldwide credit score, with $91 billion, comes subsequent, and the global non-public fairness segment, managing some $169 billion in assets, makes up the most significant share of the company’s business enterprise.

Shares in Carlyle are down 30% this calendar year, earning its losses much steeper than the all round markets. These losses have come even as the company’s revenues continue being sound. At $1.58 billion, Carlyle’s prime line in 1Q22 spun off a lot more than $183 million, a enterprise record, in payment-connected earnings – FRE, a vital business metric. The company’s FRE was up 42% year-about-year. On a destructive notice, the Q1 revenue line was down 34% from the year-back quarter.

Even even though income was down, the organization still offers increasing FRE and a balance sheet showcasing $22 billion in full assets. This gave management self confidence to elevate the dividend from 25 cents to 32.5 cents per frequent share. With an annualized rate of $1.30, this dividend yields 3.4%.

Between the bulls is JMP’s McKenna who sees the possibility/reward right here as powerful with considerable upside likely.

“Covering the area for virtually a decade, we have observed that when the current market is assigning extremely tiny to no benefit to functionality-related earnings, it is normally an attractive threat/reward possibility, and we believe this is the case for Carlyle today…. We respect that it is usually tricky to specifically predict when realizations will snap back… we have self esteem that effectiveness-linked earnings will occur back into vogue over time as markets/volatility stabilize, and we feel Carlyle will stand out on this entrance offered $4B+ of internet accrued carried desire,” McKenna opined.

All of this prompted McKenna to initiate coverage on CG with an Outperform (i.e. Buy score) and $12 rate concentrate on. This target conveys his self-assurance in CG’s potential to climb ~60% higher in the next yr.

In general, CG receives a Average Invest in from the Wall Avenue analyst consensus. This is dependent on 11 ratings, including 8 Buys and 3 Holds. The shares are investing at $37.77, and the $62.09 normal rate focus on indicates the stock has ~64% upside from latest degrees. (See CG stock forecast on TipRanks)

To locate fantastic strategies for stocks investing at appealing valuations, go to TipRanks’ Best Stocks to Acquire, a freshly released tool that unites all of TipRanks’ fairness insights.

Disclaimer: The viewpoints expressed in this report are solely these of the highlighted analysts. The information is intended to be utilised for informational applications only. It is incredibly important to do your very own assessment before earning any investment decision.