UBS Group Stock: Comments On Q2 Results (NYSE:UBS)

simarts

Soon after our initiation of coverage, nowadays we comment on UBS’s (NYSE:UBS) 2nd quarter overall performance.

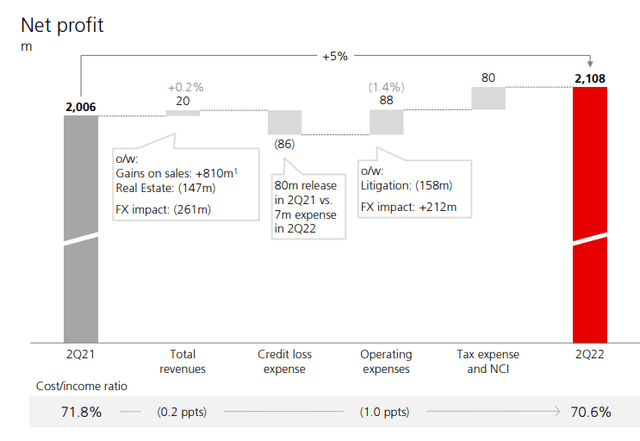

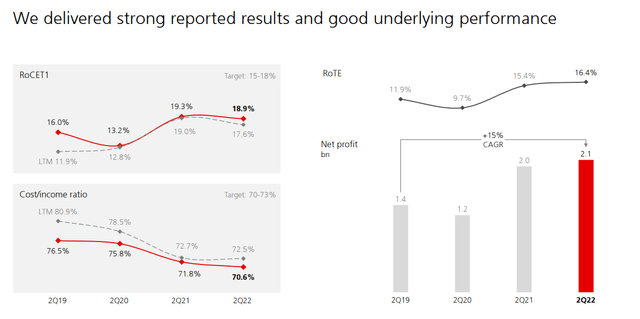

Throughout the time period, the Swiss bank recorded a web revenue of $2.11 billion in contrast to a $2.01 billion result in the exact period of time of the preceding yr (and lessen result vs . Q1). This functionality was driven by accounting sound in the corporate heart division, which negatively contributed additional than $200 million and, according to administration, this result must revert in excess of time. Wanting at the divisional contribution, we take note that International Prosperity recorded higher margins but skipped on decreased property less than administration, Asset Administration missed anticipations on reduced fees, whereas the Expenditure Bank end result was in line with Wall Avenue consensus.

Concerning the quantities, revenues stood at $8.92 billion, up from $8.90 billion in the exact period of 2021. In accordance to the consensus compiled by the Swiss group, both of those internet income and major-line income line fell small of analysts’ expectations who anticipated a internet revenue of $2.40 billion on a turnover of $9.43 billion.

Wanting at the details, UBS’s Prosperity Management Division, the flagship of the Swiss lender, experienced a 2% drop in revenues, pushed by negative industry effectiveness, adverse forex outcomes and decreased concentrations of consumer activity, significantly in the Americas and in the Asia-Pacific regions. “The next quarter was one of the hardest periods for traders in the earlier 10 a long time,” claimed CEO Ralph Hamers. “Our underlying efficiency reflects a very good outcome in an setting with lower asset stages, better volatility and mounting rates.” We understood that institutional customers had been extremely lively in the period, and we are not shocked (this need to support our thesis on Euronext and toward the London Stock Exchange Group), whilst non-public consumers remained on the sidelines.

Revenues from expense banking have been $2.094 billion, down 14% compared to the very same time period past year. The financial institution claimed a decline of $1.121 billion in web service fees, reflecting negative market performance and decreased M&A revenues.

Conclusion and Valuation

UBS claimed that it is nicely-positioned to experience the 2nd 50 % of 2022 and reiterated its strategy to repurchase about $5 billion of its shares by the end of the 12 months. CET1 ratio stood at 14.2% compared to 14.5% at the close of June 2021. Q2 functionality was mixed and the sentiment is not good thanks to reduced fees in the World wide Wealth and Asset Administration division, but our interior crew thinks that bigger costs will positively affect the company NII effectiveness. This was a tough quarter, nevertheless, UBS skipped a little on a couple strains. Consequently, we reaffirm our acquire rating on the Swiss lender and validate our goal price tag of CHF 22 for each share primarily based on a sustainable ROTE at an regular of 14.5% and a sum-of-the-components economical product on UBS’s enterprise spots.