UK debt interest payments jump to all-time high

Uk personal debt interest payments jumped to the greatest on file and pushed community sector borrowing higher than final year’s degree, suggesting minimal fiscal area for tax cuts.

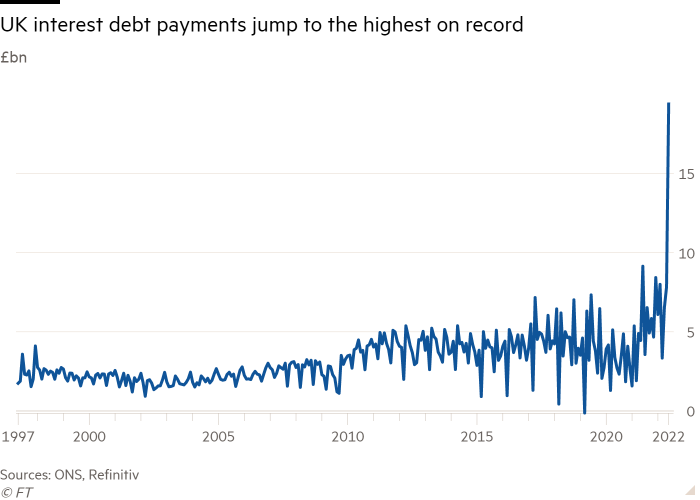

They rose to £19.4bn last month, £10.3bn far more than in June final 12 months and the optimum considering the fact that documents commenced in 1997, the Business for Countrywide Figures said on Thursday.

The figure was about double the past report in June 2021, which reflects soaring selling prices more than the past 12 months as properly as other momentary variables owing to the means credit card debt payments are accounted for.

A quarter of the UK’s authorities credit card debt is index-linked, so the price of servicing it depends straight on inflation, which is jogging at a 40-12 months significant.

The Workplace for Budget Obligation, the Uk fiscal watchdog, experienced forecast interest payments to rise to £19.7bn in June just before dropping back again to £3.9bn in July.

Further than June’s soar, desire payments are very likely to continue being superior by historic standards. Very last thirty day period the OBR famous that with the Financial institution of England anticipating inflation to hit 11 for every cent this calendar year, “debt fascination can be envisioned to proceed to overshoot our forecast”.

With bigger investing, public sector web borrowing was £22.9bn in June, £4.1bn additional than in the exact same month past calendar year. This is despite substantial personal savings from the end of most coronavirus assistance strategies.

Borrowing was marginally increased than the £22.3bn forecast by the OBR in March.

Large inflation and the economic rebound from the hit of the pandemic have boosted federal government receipts above the earlier 12 months. On the other hand, soaring prices are pushing up general public expenses and limiting economic expansion.

June’s information “may nicely be a warning shot to the incoming key minister, whoever they may well be, that the space for fiscal giveaways may well be constrained by servicing existing debt”, mentioned Sandra Horsfield, economist at Investec.