Upstream Oil Industry To See Highest Profits Ever In 2022

Public exploration and generation (E&P) organizations are on monitor to shatter earlier report earnings this 12 months as superior oil and gas charges and surging need generate money achievements. Rystad Electricity investigate shows that overall totally free dollars move (FCF)*, a company’s cash from functions just after accounting for outflows and asset upkeep, will balloon to $834 billion, a 70% increase from the $493 billion profits in 2021.

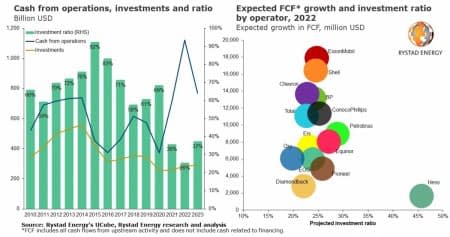

Complete FCF from community E&Ps fell to about $126 billion in 2020 as a end result of the Covid-19 pandemic and the ensuing oil cost collapse, halving the prior year’s full. As the worldwide economy rebounded and fuel demand from customers elevated, previous year’s FCF stages surged to virtually $500 billion, the highest gains ever for the upstream market.

“The current economical wellbeing of general public upstream operators is at an all-time significant. Still, the good instances are set to get even superior this yr, thanks to a excellent storm of factors pushing revenue and funds flow to a further report substantial in 2022,” claims Espen Erlingsen, Rystad Energy’s head of upstream investigate.

The main contributing element to these glowing financials is sustained substantial oil and fuel selling prices. With normal Brent oil rates approximated at $111 for every barrel in 2022, a Henry Hub fuel rate at $4.2 per thousand cubic toes (Mcf) and a European gas rate of $25 for every Mcf, whole FCF for general public upstream businesses will reach $834 billion this year.

Relevant: Buffett Is Betting Massive On Oil And Gas Stocks

Having said that, it is not just history superior FCF on the desk for community upstream operators. Income from functions** is also expected to rocket this yr, breaking the $1 trillion threshold for the to start with time. The $1.1 trillion projected yearly total is a 56% jump from 2021 stages of $719 billion, which was the maximum yearly overall given that 2014.

Hard cash from functions is normally used to fund new investments and economic charges, this sort of as financial debt payments and dividends. In 2020, money from operations dropped by pretty much $200 billion, or all around 35%, implying that businesses had fewer funds to finance new activity and challenge payouts to their homeowners. As a outcome, investments also dropped in 2020, slipping by almost $100 billion or all over 30%.

Despite the strong expansion in hard cash from operations, investments are not expected to improve drastically this year, inching up to $286 billion from $258 billion in 2021. The investment ratio*** displays the disparity in between history income stream and gains, and the part of people windfalls that are reinvested. This ratio has fluctuated during the past decade, averaging all over 72%. This calendar year, however, the projected financial commitment ratio is expected to plunge to 26%, the cheapest considering the fact that the early 1980s.

The meager investment decision ratio and soaring FCF point out that community E&P providers will have important funds accessible to shell out down credit card debt or fork out dividends to shareholders. Substantially of last year’s revenue was used on lessening personal debt, which has left upstream operators in a extremely balanced money posture. The upshot of this is that a significant portion of the broad profits expected this year will probably be paid out out to shareholders.

How the operators stack up

Nearly all the substantial general public E&P organizations will have an expense ratio concerning 20% and 30% in 2022. US unbiased Occidental Petroleum has the most affordable ratio of about 20%, though US main ExxonMobil is expected to see the most important increase in FCF in 2022, growing by about $18 billion. Compatriot impartial Hess is an outlier among the these providers with an expenditure ratio of all over 45%, owing to the company’s designs to ramp up investments in Guyana and the core US shale patch of the Bakken.

*FCF involves all funds flows from upstream action. It does not involve cash from funding or hedging results.

**Hard cash from operations is calculated as income minus operational expenditures and governing administration take.

***Investment ratio is calculated as investments divided by income from operations.

By Rystad Electricity

Far more Top rated Reads From Oilprice.com: