When Can We Expect A Profit From Squarespace, Inc. (NYSE:SQSP)?

We really feel now is a rather great time to analyse Squarespace, Inc.’s (NYSE:SQSP) business as it appears the firm could be on the cusp of a substantial accomplishment. Squarespace, Inc. operates platform for corporations and independent creators to establish on-line presence, mature their makes, and handle their organizations throughout the net. The US$2.7b sector-cap company posted a decline in its most the latest economical yr of US$250m and a latest trailing-twelve-thirty day period decline of US$341m major to an even wider gap involving decline and breakeven. As route to profitability is the subject on Squarespace’s traders mind, we’ve decided to gauge current market sentiment. Down below we will deliver a large-degree summary of the sector analysts’ expectations for the organization.

See our most recent assessment for Squarespace

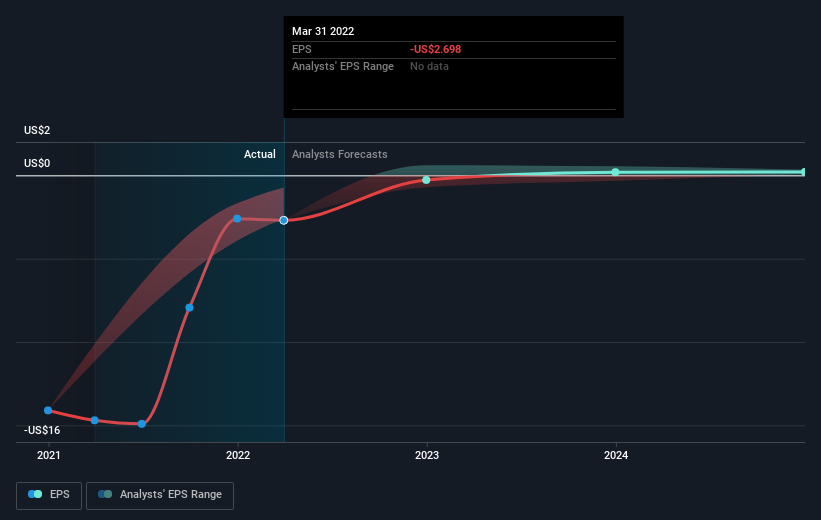

Squarespace is bordering on breakeven, according to the 16 American IT analysts. They count on the business to submit a ultimate reduction in 2022, in advance of turning a earnings of US$29m in 2023. So, the company is predicted to breakeven just above a year from now. In get to fulfill this breakeven day, we calculated the rate at which the firm need to expand 12 months-on-year. It turns out an common once-a-year growth amount of 48% is envisioned, which signals substantial self esteem from analysts. If this amount turns out to be as well intense, the firm may become rewarding substantially later on than analysts predict.

We are not going to go by organization-specific developments for Squarespace supplied that this is a substantial-amount summary, but, bear in mind that usually a significant expansion rate is not out of the everyday, specifically when a company is in a interval of expense.

Ahead of we wrap up, there’s a person situation really worth mentioning. Squarespace at the moment has negative fairness on its equilibrium sheet. Accounting approaches employed to deal with losses amassed more than time can result in this to occur. This is for the reason that liabilities are carried forward into the upcoming right until it cancels. These losses tend to manifest only on paper, however, in other conditions it can be forewarning.

Upcoming Steps:

There are critical fundamentals of Squarespace which are not covered in this short article, but we ought to tension once again that this is basically a fundamental overview. For a much more in depth glimpse at Squarespace, choose a seem at Squarespace’s company web page on Merely Wall St. We’ve also compiled a list of important factors you must even further investigation:

-

Valuation: What is Squarespace truly worth right now? Has the future growth probable presently been factored into the price? The intrinsic value infographic in our free of charge exploration report helps visualize whether Squarespace is at this time mispriced by the market.

-

Administration Team: An knowledgeable management workforce on the helm will increase our self esteem in the business enterprise – take a glimpse at who sits on Squarespace’s board and the CEO’s track record.

-

Other High-Performing Shares: Are there other stocks that offer greater prospective customers with confirmed track information? Take a look at our cost-free checklist of these terrific stocks listed here.

Have feedback on this report? Involved about the written content? Get in touch with us straight. Alternatively, email editorial-group (at) simplywallst.com.

This posting by Only Wall St is common in mother nature. We supply commentary primarily based on historical info and analyst forecasts only making use of an unbiased methodology and our content are not intended to be monetary tips. It does not represent a advice to get or sell any inventory, and does not get account of your goals, or your economic scenario. We aim to deliver you long-phrase concentrated analysis driven by elementary information. Note that our assessment may perhaps not aspect in the newest price tag-delicate firm announcements or qualitative substance. Simply Wall St has no placement in any stocks stated.