Fundamentals Of U.S. Stocks Dominating Major Indices Are More Important Than Ever

The US stock markets increasingly look to be rolling over into a new bear on extreme Fed tightening. How the leaders are faring will help determine whether that fearsome beast is really awakening from a long hibernation. The just-finishing Q1’22 earnings season reveals how the largest US companies are doing.

The mighty (SPX) is the flagship benchmark US stock index. Not only is it closely watched by nearly all traders, but its large component stocks are also heavily owned by most investors. The huge SPDR® S&P 500 (NYSE:), iShares Core S&P 500 ETF (NYSE:), and Vanguard S&P 500 ETF (NYSE:) exchange-traded funds are the biggest in the world by far, with staggering assets this week of $385.7b, $304.4b, and $258.2b!

The SPX enjoyed a blowout 2021, powering up to new all-time closing highs on fully 27% of all last year’s trading days! But after one final record close at 4,797 on this year’s opening trading day, 2022 is looking way different. Just a couple days later, heavy selling ignited on the mid-December Federal Open Market Committee meeting’s minutes. There top Fed officials had started discussing quantitative-tightening bond selling.

QT is a serious threat to stock markets levitated for years by extreme Fed money printing via quantitative easing. By mid-April that had mushroomed to an absurd $4,806.9b in just 25.5 months! The Fed’s balance sheet had skyrocketed 115.6% since March 2020’s pandemic-lockdown stock panic, effectively more than doubling the US money supply! The SPX’s 114.4% gain at best in that span mirrored monetary growth.

The last time the Fed attempted QT and rate hikes in 2018, the SPX plummeted 19.8% in 3.1 months into late December! That near-bear approach frightened top Fed officials into caving, prematurely killing both QT bond selling and rate hikes. But traders haven’t forgotten that severe market thrashing, which is why the SPX has been carving lower highs and lower lows this year as extreme-Fed-tightening jawboning mounted.

At worst in late April, the long-impervious S&P 500 had already crumbled 13.9% in just 3.8 months! This is already the worst selloff since March 2020’s stock panic, dropping ever closer to the -20% formal new-bear threshold. Recent months’ price action sure looks bear-like, a distinct downtrend well-defined by both declining upper-resistance and lower-support lines. Downlegs are followed by fierce short-covering rallies.

With a young bear probably underway but not yet confirmed, the big US stocks’ latest quarterly results are exceedingly-important. If these universally-held stalwart market generals have already been pounded to fundamentally-cheap levels, odds are higher a bear market can be averted. But if they remain expensive from that epic deluge of QE4 money printing, much-greater downside from a severe bear mauling is likely.

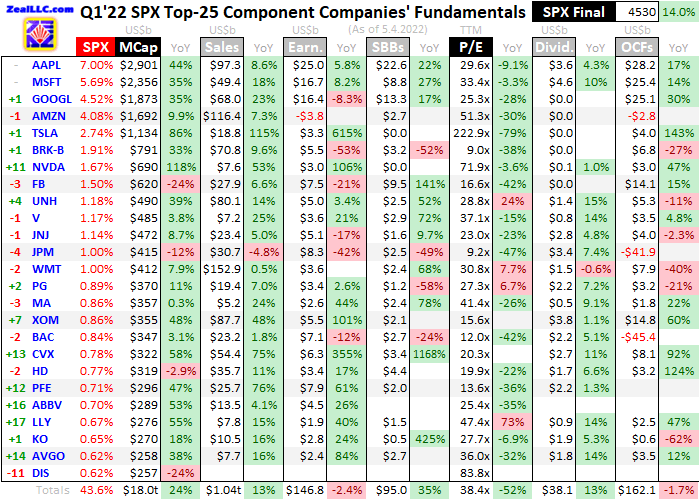

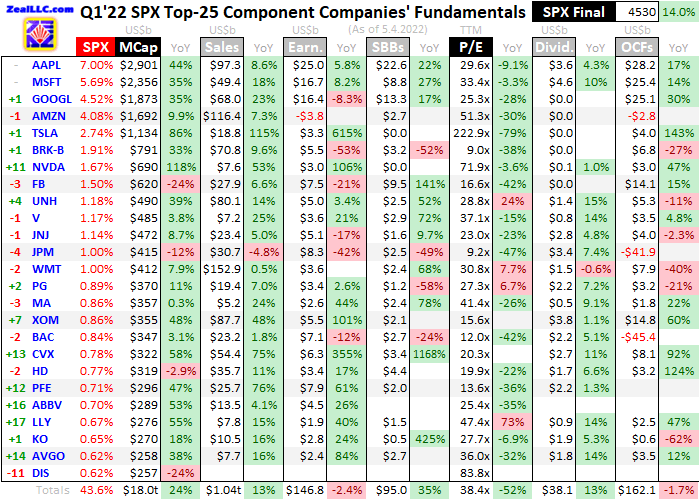

For 19 quarters in a row now, I’ve analyzed how the 25-largest US companies dominating the SPX fared in their latest earnings season. As the just-reported Q1’22 ended, these behemoths alone accounted for a heavily-concentrated 43.6% of the entire S&P 500’s weighting! The highest on record since I started this deep-research thread, the stock-market outlook is mostly-dependent on the big US stocks’ fortunes.

US companies have 40 days after quarter-ends to file comprehensive 10-Q quarterly reports with the US Securities and Exchange Commission. As of the middle of this week, 34 days had passed since that last quarter wound down. While the SPX plunged as much as 13.0% within Q1, a sharp bear-market-rally-like surge left if down just 4.9% in Q1 proper. This table below shows some key highlights from that quarter’s 10-Qs.

Each big US company’s stock symbol is preceded by its ranking change within the S&P 500 over the past year since the end of Q1’21. These symbols are followed by their stocks’ Q1’22 quarter-end weightings in the SPX, along with their enormous market capitalizations then. Market caps’ year-over-year changes are shown, revealing how those stocks performed for investors independent of manipulative stock buybacks.

Those have been off-the-charts in recent years, fueled by the Fed’s zero-interest-rate policy and trillions of dollars of bond monetizations. Stock buybacks are deceptive financial engineering undertaken to artificially boost stock prices and earnings per share, which maximizes executives’ huge compensation. Looking at market-cap changes rather than stock-price ones neutralizes some of stock buybacks’ distorting effects.

Next comes each of these big US stocks’ quarterly revenues, hard earnings under Generally Accepted Accounting Principles, stock buybacks, trailing-twelve-month price-to-earnings ratios, dividends paid, and operating cash flows generated in Q1’22 followed by their year-over-year changes. Fields are left blank if companies hadn’t reported that particular data as of mid-week, or if it doesn’t exist like negative P/E ratios.

Percentage changes are excluded if they aren’t meaningful, primarily when data shifted from positive to negative or vice-versa. These latest quarterly results are very important for American stock investors, including anyone with retirement accounts, to understand. They illuminate whether these lofty US stock markets are fundamentally-sound in the face of very-bearish aggressive Fed rate hikes and QT bond selling.

These 25-largest US stocks dominating the American stock markets are all fantastic companies with great businesses. There’s no other way they could grow so massive. But being awesome doesn’t mean their underlying fundamentals justify their stock prices. Valuations are ignored in late-stage bulls as euphoric momentum-chasing buying reigns. But how expensive stocks are fuels bears, driving their sizes and durations.

Again commanding a staggering 43.6% of the SPX’s entire market cap as Q1’22 wound down, these elite stocks effectively are the US markets! The concentration risk is even worse than that indicates, since the top-5 beloved mega-cap tech stocks alone account for 24.0% of the SPX! Exiting last quarter they were mostly-usual market-darling suspects Apple (NASDAQ:), Microsoft (NASDAQ:), Alphabet (NASDAQ:), Amazon (NASDAQ:), and Tesla (NASDAQ:). Meta dropped to 8th!

While that former Facebook (NASDAQ:) has been crushed this year, it still has far more in common with the top-4 US stocks than that leading electric-car manufacturer. For years I’ve broken out the top 5 separately, which long included AAPL, MSFT, GOOGL, AMZN, and FB. I’m going to keep that traditional mega-cap-tech grouping today, even though Meta has fallen from grace. So FB is still considered top-5 and TSLA bottom-20.

The collective market caps of these 25-largest US stocks blasted 24.0% higher year-over-year between the ends of Q1’21 to Q1’22 to $18,046.6b! That trounced the overall SPX, which saw much-more-modest 14.0% gains. That reflects institutional investors increasingly crowding into the biggest US companies, simply because their stocks have enjoyed the best returns. That spawns virtuous circles of huge capital inflows.

Overall revenues at the SPX top 25 last quarter soared a phenomenal 13.1% YoY to $1,041.4b! That’s amazing growth at the vast scales these giants operate at, and a major new all-time-record high. But with inflation raging thanks to the Fed’s extreme QE4 money printing, bigger sales dollars also reflect surging general-price levels. The latest Consumer Price Index inflation print in March rocketed up a scary 8.5% YoY!

For years big US stocks’ overall revenue growth was disproportionally won by those top-5 mega-cap techs. But interestingly that wasn’t the case in Q1, despite them enjoying excellent 11.7%-YoY sales increases to $359.0b. Surprisingly the next-20-largest SPX stocks bettered that, reporting sales climbing a larger 13.9% YoY to $682.4b! Inflation or not, that implies the largest American companies are faring great.

Unfortunately that is misleading, resulting from major composition changes among the SPX top 25 rather than actual results. Normally the rankings among these elite companies don’t change much, but this past year has been an extraordinary exception. Chevron (NYSE:), Pfizer (NYSE:), AbbVie (NYSE:), Eli Lilly (NYSE:), and Broadcom (NASDAQ:) all charged up by double-digit rankings changes to achieve biggest-US-company status! That is incredibly-unusual.

Since the S&P 500 is weighted by components’ market capitalizations, that means these newer stocks enjoyed bigger rallies over this past year displacing struggling ones. A couple high-profile examples are PayPal (NASDAQ:) and Netflix (NASDAQ:), which plummeted from 19th and 25th in the comparable Q1’21 to 61st and 49th in this recently-finished Q1’22! These market-darlings’ smaller sales and profits never justified huge market caps.

Last quarter, this pair of falling-from-favor companies merely reported collective revenues and earnings of $14.4b and $2.1b. Meanwhile the two companies that replaced them in the SPX top 25 dwarfed that, with an enormous $80.0b and $14.1b in Q1 sales and profits! Oil super-major Chevron accounted for most of that, with revenues and earnings skyrocketing 75.0% and 354.5% YoY on much-higher crude-oil prices.

In US terms quarterly-average oil prices soared 63.4% YoY to $94.98, resulting in a huge windfall for the big oil companies! Exxon Mobil (NYSE:) also contributed to surging SPX-top-25 sales with massive 48.3%-YoY growth. After Chevron the next-largest new company in these elite ranks is Pfizer. Selling those mRNA COVID-19 injections has been gangbusters business, as PFE’s sales and profits soared 76.0% and 61.2% YoY!

So had Chevron and Pfizer alone not replaced PayPal and Netflix, overall SPX-top-25 revenues would have been $65.7b lower in Q1’22. The big US stocks’ sales aren’t as great as they look, much of their big growth is composition changes. Naturally the same is true on the hard-earnings front under Generally Accepted Accounting Principles. Overall SPX-top-25 accounting profits actually slumped 2.4% YoY to $146.8b!

Ominously that’s the first time aggregate profits of the biggest US companies fell since Q2’20, which was the dark heart of pandemic lockdowns. Lower profits absolutely are even more stunning considering all this red-hot inflation driving up price levels. Shockingly all those declines came from those elite top-5 mega-cap techs, which saw earnings implode 17.2% YoY to $61.8b! Even their fantastic businesses are flagging.

Not Apple and Microsoft, which still enjoyed good 5.8% and 8.2%-YoY profits growth. But earnings fell 8.3% and 21.4% YoY at Alphabet and Meta, while Amazon’s plummeted from an $8.1b profit in Q1’21 to a $3.8b loss in Q1’22! Long considered fortress stocks immune from worries, AMZN stock crashed a brutal 14.0% the day after it reported Q1 results! Q2 sales guidance was 5.2% below Wall Street estimates.

The next-20-largest SPX stocks including Tesla saw earnings soar 12.2% YoY last quarter to $85.0b! Elon Musk’s cult-favorite electric-car maker contributed, with profits skyrocketing 615.1% YoY to $3.3b. But those far-higher corporate earnings were overwhelmingly driven by composition changes, with just CVX and PFE reporting $12.0b more in Q1 profits than the knocked-out-of-these-rankings PYPL and NFLX.

Had those displacements alone not happened, overall SPX-top-25 earnings would’ve fallen 10.4% YoY. Raging inflation is very corrosive to corporate profits. Companies can’t pass along all their higher input costs to customers, as raising selling prices big-and-fast would drive away plenty. But even modest price hikes erode sales as some customers look for substitutes, or choose to do without. Weaker earnings are likely.

But big US companies’ managements aren’t battening down the hatches preparing for the Fed’s inflation tsunami to slow their businesses considerably. Instead they continued buying back their stocks like there is no tomorrow, maximizing their personal compensation. Total stock buybacks across these SPX-top-25 companies in Q1’22 soared a mind-boggling 35.1% YoY to $95.0b! Those mega-cap techs accounted for 6/10ths!

Pouring shareholders’ cash at these vast levels into manipulating stock prices higher isn’t sustainable. Mighty Apple has built the biggest business the world has ever seen around ubiquitous pocket computers. But even it can’t afford the $22.6b and $3.6b it plowed into stock buybacks and dividends last quarter. Together those added up to 104.9% of quarterly earnings. Meta’s buybacks were 127.3% of its Q1’22 profits!

It wasn’t just the mega-cap techs spending more on stock buybacks and dividends than their businesses generated in GAAP-profits terms. Walmart (NYSE:), Home Depot (NYSE:), Eli Lilly, and Broadcom spent 110.7%, 183.6%, 125.4%, and 187.2% of their quarterly profits on “returning cash to shareholders”! Dividends actually do that, but stock buybacks are ultimately wasteful and manipulative. They aren’t a productive use of scarce capital.

Our quarterly-earnings spreadsheet includes much more data than I can fit into these tables, including the cash positions of these big US stocks. Their overall cash treasuries plunged 14.5% YoY to $745.9b in Q1’22, with similar declines among both the top-5 and next-20 largest! With inflation cutting into profits, these elite US companies can’t afford to burn big cash for long to fund outsized stock buybacks and pay dividends.

Since cash dividends are so important to investors, companies will slash their much-larger repurchases long before quarterly direct payments. Total dividends among these SPX-top-25 companies grew a way-slower 12.6% YoY to a much-smaller $38.1b. Overall stock buybacks dwarfed that, again up 35.1% YoY to $95.0b. So buying back their own stocks will come to the chopping block as corporate profits and cash wane.

The Fed’s new accelerated rate-hike cycle will also have a serious dampening effect on recent years’ stock-buyback mania. Since many elite companies were plowing more money into manipulating stock prices than their earnings could support, they borrowed money for buybacks. But with the Fed’s zero-interest-rate policy dead and borrowing costs surging, debt-financing repurchases will get way-more expensive.

Ominously the single-largest source of overall stock demand for years now has been stock buybacks! So if companies are forced to pare those back due to inflation eroding profits and higher interest rates, that is very-bearish for US stock markets. Lower buybacks going forward greatly increase the odds a new bear is indeed underway. Weaker share demand from companies as share supplies rise from selling is a dire omen.

The SPX top 25’s operating-cashflow generation also reflects slowing businesses despite those major composition changes in these elite ranks. Excluding the giant money-center banks JPMorgan Chase (NYSE:) and Bank of America (NYSE:) which have wild cashflow volatility, the rest of the big US stocks saw their overall OCFs slump 1.7% lower YoY to $162.1b. And that is also skewed high by CVX and PFE replacing PYPL and NFLX.

With both accounting earnings and operating cashflows declining last quarter, by considerably more than the totals suggest due to composition changes, the US economy is apparently slowing. The initial read on US Q1 GDP confirmed what corporate profits are signaling, which surprised last week revealing 1.4% annualized shrinkage compared to a +1.0% consensus forecast! Inflation is already retarding spending.

That certainly makes sense. With the costs of necessities surging dramatically, well into the double-digit percentages regardless of what lowballed CPI inflation claims, Americans have less discretionary income to purchase the goods and services the biggest US companies are selling. While we all have to buy food, energy, and gasoline regardless of how expensive, we don’t have to buy any of the stuff sold on Amazon.

The Fed’s raging inflation undermining the US dollar’s purchasing power will have far-reaching impacts on corporate sales and profits. People will likely run their iPhones longer before upgrading, and probably won’t buy as many luxury electric cars and discrete computer-graphics cards. Home-improvement projects and Disney vacations will be harder to budget for. And big US stocks’ revenues and earnings will suffer.

A likely-serious economic slowdown has huge implications for valuations, how expensive stock prices are relative to their underlying corporate earnings. And at the end of Q1’22, well before that quarter’s results were subsequently released and included in trailing-twelve-month price-to-earnings ratios, big US stocks’ valuations remained deep into dangerous bubble territory. The SPX top 25 averaged lofty 38.4x TTM P/Es!

Wildly that was a huge improvement, plunging 51.9% YoY from Q1’21’s scary 79.8x. But that was mostly from Tesla, which saw its P/E collapse 78.6% YoY to a still-ridiculous 222.9x as March ended. Ex-Tesla since it is such an extreme outlier, the rest of the SPX-top-25 stocks saw their average TTM P/Es retreat 15.2% YoY to 30.7x in Q1’22. That still exceeds the historical bubble threshold of 28x, which spells big trouble.

Bear markets exist solely to maul stock prices sideways-to-lower for long enough for underlying earnings to catch up. Stock valuations are bid to unsustainable extremes in late-stage bull markets, necessitating subsequent bears to rebalance and normalize stock prices relative to profits. Bears usually ignite with stock-market valuations more than double their century-and-a-half average fair-value running 14x earnings.

That’s certainly the case today, after US stocks traded at lofty bubble valuations for years as the Fed’s extreme money printing directly levitated them. Then once awakened, bears don’t tend to lumber back into hibernation until general valuations are back down under fair-value. Even if earnings stay steady and defy inflation’s corrosion, the SPX would have to collapse 54.4% from early January’s peak to 2,189 to hit 14x!

That sounds crazy after long years of artificially-elevated stock prices thanks to extreme Fed easing, but it isn’t unusual. The last couple major valuation-driven bears ending in October 2002 and March 2009 saw the SPX mauled 49.1% and 56.8% lower over 2.6 and 1.4 years! Bear markets are nothing to be trifled with, and the odds the next major one is underway are certainly mounting given SPX technicals and fundamentals.

So with bubble valuations festering as the Fed both aggressively hikes rates and ramps up QT monetary destruction to never-before-attempted levels, what should investors do? Stay wary, avoid getting lulled into complacency by sharp bear-market-rally-like surges. Ratchet-up your stop losses to lock in more of your gains. And greatly up your portfolio allocation in counter-moving gold, which flourishes in bears and inflation.

During the last similar inflation super-spikes in the 1970s, gold prices nearly tripled during the first and more than quadrupled in the second! Gold also thrived during past Fed-rate-hike cycles, which are very bearish for stock markets. Gold and its miners’ stocks, which really amplify their metal’s gains, are still running despite a sharp recent pullback. They will soar as gold powers higher on surging investment demand.

The bottom line is the big US stocks’ latest quarterly results exacerbated the risks a young bear market is awakening. Despite record sales partially fueled by the Fed’s raging inflation, both accounting profits and operating cashflows still slumped. Higher input costs are already eroding margins, eating into earnings. That’s a big problem with valuations still remaining way up in dangerous bubble territory before Q1’22 results.

And the Fed panicking to slay its inflation monster promises much more fundamental pain for big US stocks. The most-aggressive rate hikes in decades combined with the fastest QT monetary destruction ever dared is incredibly-bearish for corporate earnings and recent years’ stock-buyback mania. With stocks still bubble-valued heading into this dreadful mess, staving off a long-Fed-starved bear seems impossible.